Gold prices dipped to a two-week low on Monday after results from the French presidential elections abated investor appetite for the precious metal. Major stock markets around the globe and the euro rallied, while the dollar fell to a new five-month low. Increasing interest in riskier assets may undermine demand for gold.

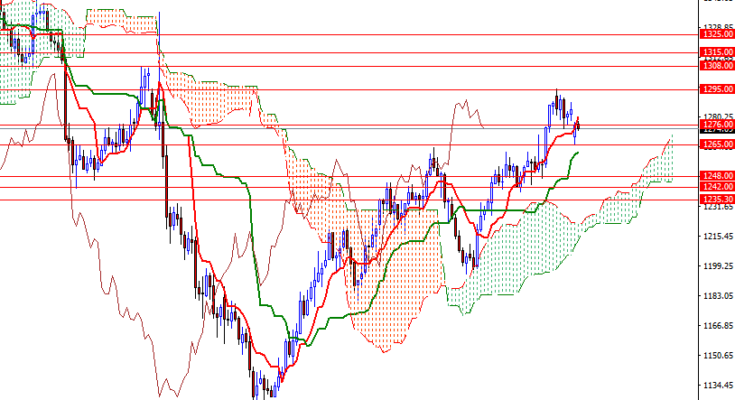

Yesterday’s gap dragged the XAU/USD pair into the Ichimoku clouds on the 4-hour time frame. The short-term charts are slightly bearish at the moment, with the market trading below the Ichimoku cloud on the H1 time frame. The market bounced off of the strategic support at 1265 but the bulls will need to push prices back above the 1285 level, which happens to be the top of the 4-hourly clouds, if they intend to tackle the 1289/8 zone. Penetrating 1289/8 could provide the bulls the extra fuel they need to reach the next barrier standing in the 1295/2 area.

On the other hand, if the bears take the reins and the market falls through 1270.60-1268.50, we will probably revisit the support at 1265. A break down below 1265 implies that the 1261 level will be the next stop. Breaching this support on a daily basis would open a path to 1257/5.