With traders realizing that the “Thursday Turmoil Trifecta” looms, world stocks dropped and safe-haven assets rose as investors focused on the growing tension in the Middle East, while caution spread across markets in a week full of risk events including James Comey’s congressional testimony to the ECB’s policy meeting and Britain’s increasingly uncertain election, all in the span of 24 hours. As a result, European and Asian stocks as well as S&P futures all fell, while gold, yen and Treasuries gained.

World stocks edged further away from record highs hit last week, the MSCI world equity index fell 0.12%. Crude continued to decline despite OPEC’s best efforts to stabilize its price, with WTI edging lower by 0.2% to $47.33 a barrel, after dropping as much as 1% and rising as much as 0.7% earlier.

Quick recap of the trading action so far courtesy of Bloomberg’s macro squawk wrap:

Europe follows defensive Asian session with little appetite for risk before events later in the week. USTs continue overnight rally, Eurodollar curve bull-flattens, bund and gilt futures move higher in tandem. DAX reopens after Whit Monday holiday and underperforms other European equity markets, construction sector lags; Banco Popular trades with small gains +1.8% after recent heavy losses. USD/JPY at overnight lows amid broad risk-off, USD grinds marginally higher from overnight lows against G-10; spot gold trades approximately $5 away from YTD high, EMFX led lower by ZAR, which spikes lower after South African economy enters recession. Focus overnight on PBOC conducting a 498b yuan 1-year MLF operation, Hibor rates continue to normalize after recent spike higher.

In an otherwise quiet session, the big FX outlier was the yen which rose 0.7% to 109.70 per dollar, reaching the strongest level in six weeks, since April 21. The yen outperformed G10 currencies on haven demand while the pound also gained against the dollar ahead of Thursday’s U.K. election.Declines in stocks and U.S. Treasury yields prompted yen buying, leading it to break the key 110 level against the dollar in Asian trading.

“Investors appear nervous ahead of several key events on Thursday including the U.K. election, former FBI Director James Comey’s testimony before the U.S. Senate and the ECB meeting,†Credit Agricole SA strategists including Manuel Oliveri said in a note to clients

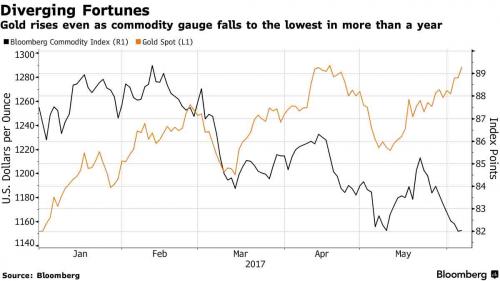

Gold, which has become an inverse trade on the USD/JPY, spiked above $1,290, advancing for a third day to the highest since April 18.

10-year Treasury yields fell to near the lowest since November. The dollar traded at an eight-month low.

Europe’s benchmark share index dropped the most in a week led by Swiss pharmaceutical company Roche Holding AG after one of its drug studies disappointed. Miners were among the biggest losers again as Bloomberg’s commodities index declined a sixth day. In Asia, Japan’s Topix index fell 0.8 percent after the yen strengthened. Australia’s S&P/ASX 200 tumbled 1.5 percent, the most in more than two months and reaching the lowest since February. The Aussie dollar swung between gains and losses after the central bank left its benchmark interest rate unchanged.

The Stoxx Europe 600 Index declined 0.4 percent and the FTSE 100 fell 0.2 percent. Futures on the S&P 500 Index dropped 0.1 percent after the underlying gauge slid 0.1 percent Monday. Qatari stocks steadied after plunging the most since 2009 on Monday. Saudi Arabia and three other Arab countries severed most diplomatic and economic ties to the country.

As Thursday Turmoil Trifecta, Bloomberg again reminds us that all three major events – Comey, the ECB meet and British election – are set for Thursday, and as a result investors’ risk-off mood this week is understandable. It’s been compounded by a diplomatic spat among energy producing nations in the Middle East and a terror attack in London.

“There is not much scheduled today that could potentially inspire the markets as the main focus this week is on ‘Super Thursday,â€â€™ Piotr Matys, a London-based currency strategist at Rabobank, wrote in a client note. “Essentially, we brace for a volatile session on Thursday and Friday as at least one of those crucial events could trigger sharp moves in the markets.â€

Then there was Reuters, which notes that on what BayernLB analysts called “Super Thursday”, British voters will go to polls in an increasingly unpredictable general election, the European Central Bank is due to meet and later the same day former FBI director James Comey will testify before Congress.

“We have a big week or so ahead of us with the UK heading to the polls and the ECB announcing its latest monetary policy decision on Thursday and the Federal Reserve doing the same next Wednesday,” said Craig Erlam, a market analyst for OANDA securities. “Once these events pass, we may have a little more clarity and therefore see a little less caution in the markets.”

The dollar, meanwhile, touched a seven-month low ahead of Comey’s testimony. Reports suggest the former FBI chief plans to talk about conversations in which U.S. President Trump pressured him to drop his investigation into former national security adviser Mike Flynn, who was fired for failing to disclose conversations with Russian officials. The dollar index which tracks the currency against a basket of trade-weighted peers, fell to its lowest level since the November U.S. election.