Gold prices ended Monday’s session down $12.08 as investors awaited a Federal Reserve meeting and US nonfarm payrolls report later in the week. The XAU/USD pair was able to cleanly break down below the key support at $1261, and as a result, the market reached the $1257/5 area as expected. The market is trying to stay above the $1255 level today, but as I warned in my weekly analysis the risk of a retreat towards $1250/48 remains high unless the short-term charts improve.

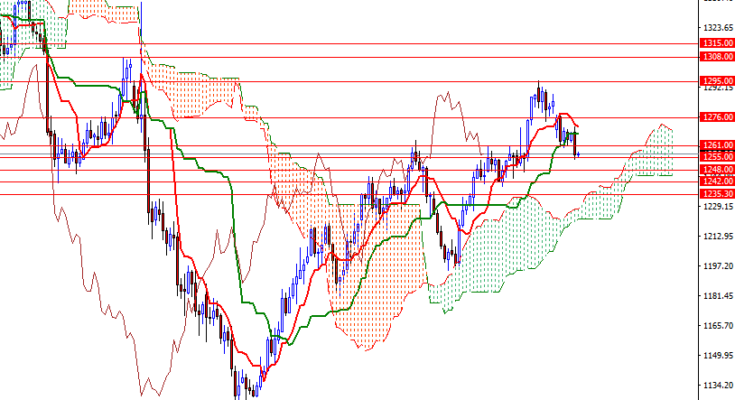

Prices are moving below the Ichimoku cloud on the 4H chart and we have a bearish Tenkan-sen (nine-period moving average, red line) – Kijun-sen (twenty six-period moving average, green line) cross. If XAU/USD falls through this area and break below yesterday’s low, keep an eye on the aforementioned support in 1250/48. Invalidating this support would suggest that the market is on its way to test 1242/0.

To the upside, there are hurdles such as 1261 and 1264. If prices recover and climbs back above 1264, then the market may find a change to approach the 4-hourly cloud. In that case, the market will be aiming for 1270.60-1269.65. Beyond there, the 1277.35-1276 area stands out, and the bulls have to overcome this barrier in order to proceed to 1288/5.