Central banks remain powerful creatures. Will gold escape from their grip?

Bank of Japan

It’s a hot period in central banking. On Tuesday, the Bank of Japan kept its monetary policy on hold. Kuroda tried to convince the markets that the BoJ won’t follow the Fed towards an exit from easy monetary policy soon. “We haven’t reached the stage of thinking about how to handle an exit [from monetary easing]â€, he said. The BoJ Governor also insisted that the bank is fully committed to easy monetary policy and is not about to scale back its stimulus.

However, the Japanese economy enjoys strong economic momentum. It has recorded seven consecutive quarters of positive growth, with the average annual rate reaching 1.9 percent. And with the unemployment rate at 2.7 percent, the country is now at full employment. What is only missing is inflation. But Kuroda stated in Davos that the inflation is now close to the BoJ’s target. He said:

There are some indications that wages are actually rising and some prices have started to rise (…) There are many factors that made the 2 percent target difficult and time-consuming but we are finally close.

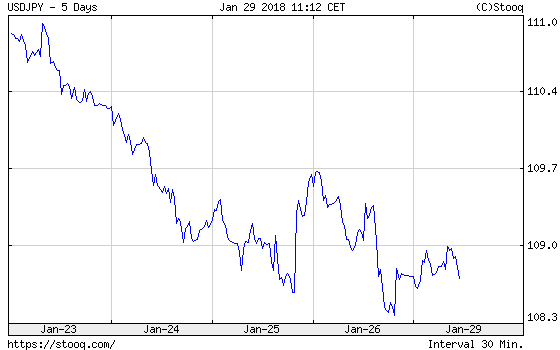

As a consequence, investors remained optimistic about monetary policy normalization in Japan in the future. As one can in the chart below, the Japanese yen strengthened the greenback. It was music to gold’s ears.

Chart 1: USD/JPY exchange rate over the last five days.

Â

ECB

On Thursday, the ECB released its most recent monetary policy statement, while Draghi answered questions at the press conference. The ECB also kept its monetary policy unchanged. However, in his introductory statement, Draghi was quite optimistic about inflation.

The strong cyclical momentum, the ongoing reduction of economic slack and increasing capacity utilization strengthen further our confidence that inflation will converge towards our inflation aim of below, but close to, 2%.