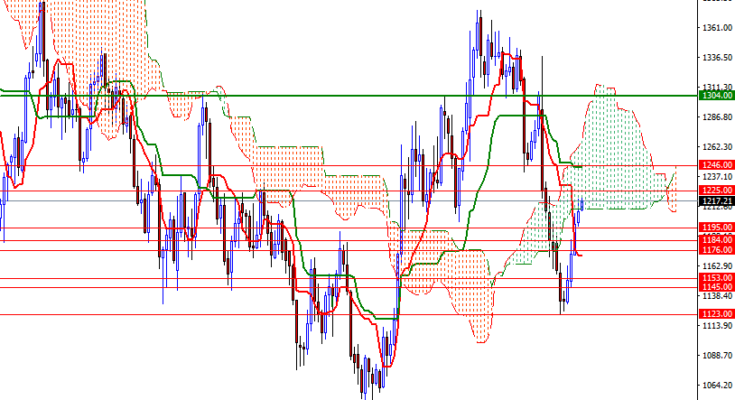

Gold prices rose $8.51 on Monday to settle at their highest level since mid-November as the greenback continued to weaken and equities edged lower. The XAU/USD pair traded as high as $1219.94 an ounce before pulling slightly back to the current levels. The key levels which I underlined in my weekly analysis remain the same as the support in the $1208/5 area wasn’t tested and $1220/19 held as resistance.

XAU/USD is moving inside the weekly and daily Ichimoku clouds and in addition to that the weekly Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines are flat, suggesting that the market is looking for a direction. As pointed out before, a successful break above the 1220/19 zone is essential for a bullish continuation. If that is the case, it is likely that the market will visit the 1225 level. Closing above 1225 could give the bulls a chance to march towards the 1237/2 resistance zone.

If the market can’t penetrate 1220/19 and prices reverse, keep an eye on the 1208/5 area. The bears will have to demolish that support so that they can proceed to the 1200-1199 zone. Once below that, the market will be aiming for the 1195 level which happens to be the bottom of the Ichimoku cloud on the 4-hour chart. Breaking below 1195 on a daily basis could drag prices back to the 1190.50-1187 support.