Image Source:

Image Source:

Gold price (XAU/USD) attracts some dip-buying during the Asian session on Thursday and for now, seems to have stalled its retracement slide from the $2,600 mark, or a fresh all-time peak touched the previous day. The US dollar (USD) trims a part of its intraday gains to a one-week high, which turns out to be a key factor lending support to the commodity. Furthermore, concerns about an economic slowdown in the United States (US) and China – the world’s two largest economies – and geopolitical risks stemming from the ongoing conflicts in the Middle East benefit the safe-haven precious metal.Meanwhile, receding hopes for a more aggressive policy easing by the Federal Reserve (Fed) continue to push the US Treasury bond yields higher. This could act as a tailwind for the Greenback and keep a lid on any meaningful appreciating move for the non-yielding Gold price. This makes it prudent to wait for some follow-through buying before positioning for the resumption of the prior well-established uptrend. Traders now look to the US economic docket – featuring the usual Weekly Initial Jobless Claims, the Philly Fed Manufacturing Index and Existing Home Sales – for a fresh impetus.

Daily Digest Market Movers: Gold price attracts haven flows amid geopolitical risks, rising US bond yields to cap gains

Technical Outlook: Gold price bulls have the upper hand while above $2,532-2,530 resistance breakpoint

From a technical perspective, any subsequent slide is more likely to find decent support near the previous cycle high, around the $2,532-2,530 area. Some follow-through selling will expose the next relevant support near the $2,517-2,515 area, below which the Gold price could accelerate the corrective decline to the $2,500 psychological mark. The downward trajectory could extend further towards the $2,470 confluence – comprising the 50-day Simple Moving Average (SMA) and the lower boundary of a short-term ascending channel. The latter should act as a key pivotal point, which if broken decisively might shift the near-term bias in favor of bearish traders. On the flip side, the $2,577-2,578 region now seems to act as an immediate hurdle ahead of the $2,600 mark, or the all-time peak touched on Wednesday. The subsequent move up could allow the Gold price to challenge the trend-channel resistance, currently pegged near the $2,610-2,612 region. A convincing breakout through the said barrier will be seen as a fresh trigger and set the stage for an extension of the recent well-established uptrend witnessed over the past three months or so.

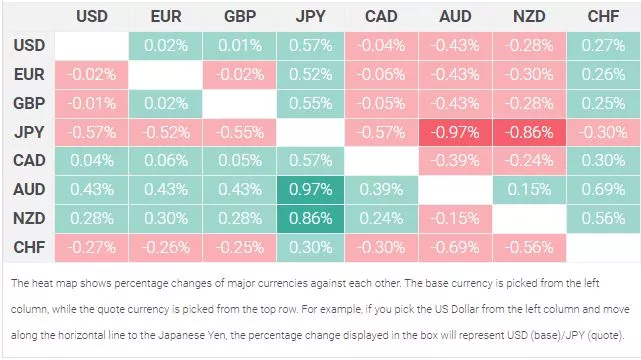

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen. More By This Author:GBP/JPY Struggles To Capitalize On Post-UK CPI Rise, Down A Little Above 187.00 AUD/USD Climbs Further Beyond Mid-0.6700s, Nearly Two-Week High Ahead Of US Retail Sales US Dollar Extends Losses As Fed Decision Looms

More By This Author:GBP/JPY Struggles To Capitalize On Post-UK CPI Rise, Down A Little Above 187.00 AUD/USD Climbs Further Beyond Mid-0.6700s, Nearly Two-Week High Ahead Of US Retail Sales US Dollar Extends Losses As Fed Decision Looms