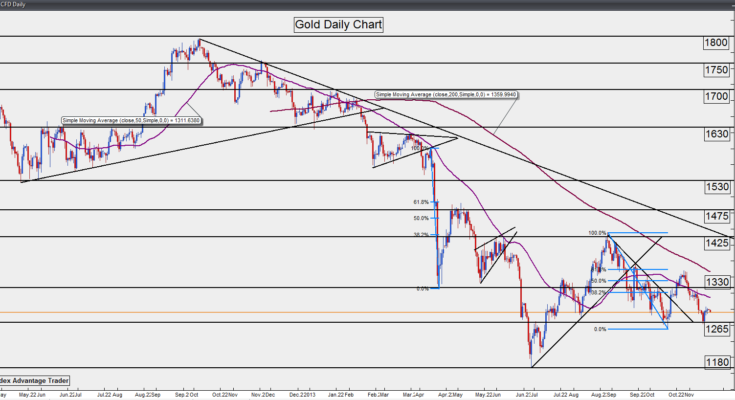

November 18, 2013 – Gold (daily chart) has tentatively maintained its slight rebound off a short-term double-bottoming pattern around the 1250-1265 support zone. The 1265 area has served as a major support/resistance level in the recent past. After hitting a multi-year low of 1180 in late June on the tail-end of a dramatic 9-month plunge from last year’s 1800-area high, gold has been on a choppy ride of sharp ups and downs.

Although still technically entrenched in a strong bearish trend, as indicated by both the 50- and 200-day moving averages, the precious metal will likely see continued directionless whipsaw, at least for the near-term. This condition should prevail until there is a substantial move either below the 1180 multi-year low, which would indicate a clear downtrend continuation, or above the 1425 area, which would provide a likely indication of an upside reversal. In the meantime, the key downside level to watch would be the noted 1250-1265 support zone, a breakdown below which should target 1180. To the upside, the next major resistance objective is around 1320-1330, a breakout above which could shoot for the 1365 and then 1425 resistance levels.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.