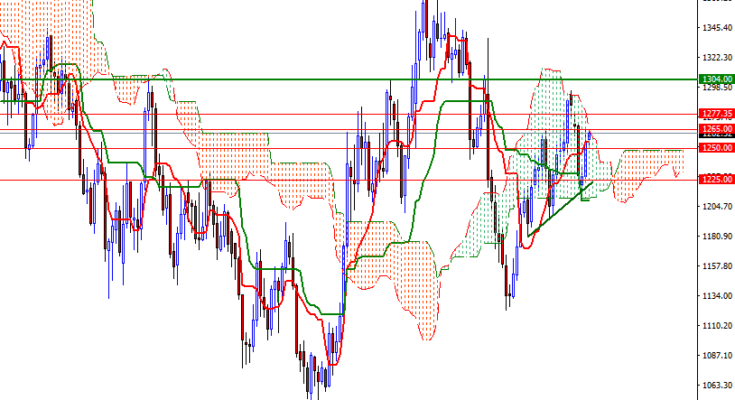

Gold started the week on a positive note, testing the $1265/1 area after the market found support just above the $1250 level. This week sees the release of minutes from the U.S. Federal Reserve’s latest policy meeting, so people may be reluctant to make aggressive bets prior to the event. Since XAU/USD traveled a short distance yesterday, the key levels I mentioned in my previous analysis are still valid.

Gold’s technical picture remains bullish, with the market trading above the Ichimoku clouds on the daily and the 4-hourly charts. The area occupied by the daily and the 4-hourly clouds (roughly between 1255 and 1240) should continue to be supportive in the near term. However, beware that the market is still moving inside the weekly cloud.

The bulls have to overcome the resistance in the 1265/1 area in order to tackle 1271.50-1269. Penetrating this barrier on a daily basis cloud could prolong the bullish momentum and open a path to 1277.35-1276. If the bears successfully defend the 1265 level and increase the selling pressure, prices may pull back to 1257/5. Breaking down below there indicates that the market is on its way to 1252/0.

Â