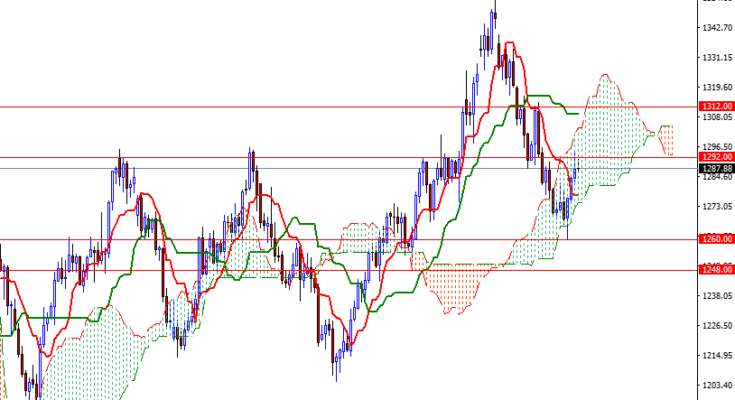

Gold prices rose for a third straight session on Tuesday and settled at $1287.63 an ounce as the dollar fell ahead of the minutes of the Federal Reserve’s September policy meeting and inflation data. XAU/USD reached the $1292-$1290 area as expected but was unable to break through. Consequently, prices retreated to Ichimoku cloud on the M30 chart. This area has been supportive so far but if prices drops through, we could visit the $1285-$1284 zone.

Prices are above the weekly cloud, indicating that the bulls have the medium-term technical advantage. However, the market is trapped inside the daily and the 4-hourly clouds. Ichimoku clouds not only identify the trend but also represent support and resistance zones. Basically, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself.

A sustained break above 1292 implies that 1298/6 zone will be the next target. If the bulls clear this strategic resistance, then they may have a chance to test the 1302 level. A break down below 1285/4, on the other hand, could see a fall to 1282/1. The bottom the 4-hourly cloud sits in the 1279/6 area so the bears will have to pull prices below there if they intend to challenge 1270/68.