The market started the week on the back foot but found support around the $1193 area as buyers stepped in and ended Friday’s session up 1.15%, or $13.53, to settle at $1207.71 an ounce. Apparently the dollar’s uptrend is likely to continue to provide a headwind for the precious metal but the possibility that the Fed could wait until September is influencing the short-term outlook. Friday’s data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 100757 contracts (the highest level in five weeks), from 80019 a week earlier.

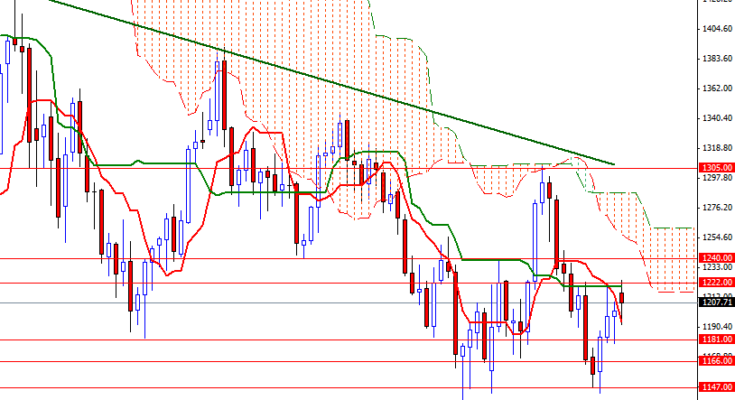

From a purely technical point of view, I think there are two things to pay close attention. Firstly, the XAU/USD pair is trading below the Ichimoku clouds on the weekly and daily time frames, plus the area between the 1240 and 1257 levels acted as both support and resistance several times in the past. This picture suggests that there are tough resistance levels ahead and because of that higher prices will continue to lure sellers in the medium-term. On the other hand, the XAU/USD pair is trading above the cloud on the 4-hour time frame and managed to end the week beyond the 1205 level (Fibonacci 38.2) after Friday’s bullish price action which almost engulfed the previous two candles.

Â

With that in mind, if the bulls gain more traction and successfully push prices above 1214.50 – 1211, we might see a push up towards the 1225/0 zone where the weekly Kijun-sen (twenty six-day moving average, green line) and 50% retracement level reside. Closing above 1225 could signal a run up to 1240 or possibly even 1257. While the short term outlook is slightly positive, there is the possibility of returning the 1193/1 region if the XAU/USD pair breach the 1198 support level. A daily close below 1191 would indicate that there is a chance we will see the pair fall further to the 1183.27 – 1181 support.

Â