Gold prices dropped $9.12 on Wednesday as the dollar extended its rally. Easing geopolitical concerns dulled desire for safe haven diversification and pushed major U.S. stock indexes to fresh records. XAU/USD initially tried to break out to the upside but the anticipated resistance at around the $1332 level kicked in and capped the market. Consequently, the market fell through $1323-$1321 and tested the support at $1318 in Asia session today.

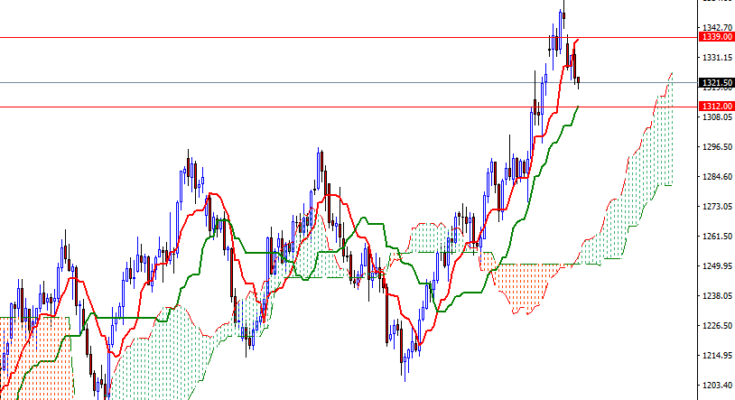

The short-term charts are still bearish, with the market trading below the Ichimoku cloud. We also have negative Tenkan-sen (nine-period moving average, red line) – Kijun-sen (twenty six-period moving average, green line) crosses on both H1 and M30 time frames. With that in mind, I expect the near-term trading range to be roughly between 1332 and 1312.

The bulls will have to push prices above the hourly cloud in order to ease the recent selling pressure and make a move to 1334.60-1332. A breach of this barrier could push XAU/USD towards 1339/8. To the downside, keep an eye on the anticipated support in the 1318-1316.50 zone. If this support is broken, then the market will be targeting 1312. A successful break below 1312 sends prices to 1304/0.