- Gold has been riding as US Treasury yields are retreating.

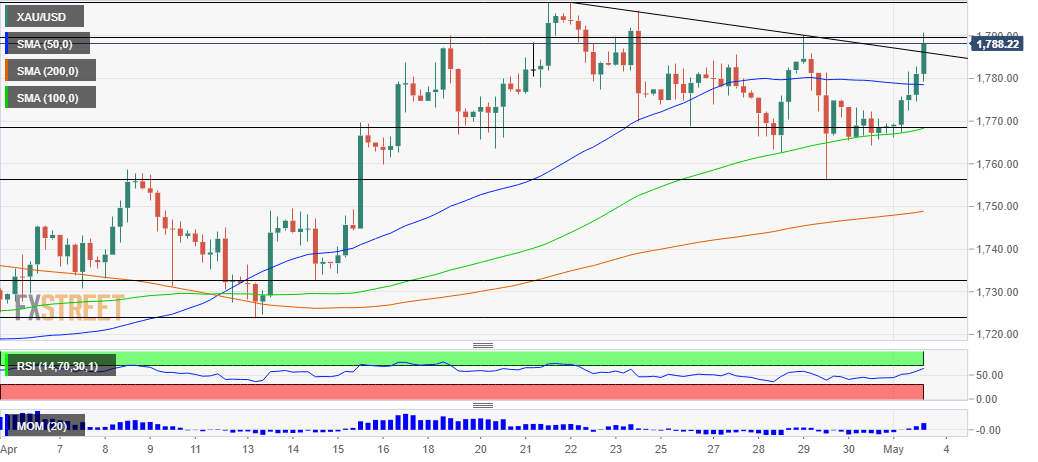

- XAU/USD is on course to break above the downtrend resistance line.

- Momentum on the four-hour chart has turned positive, providing another oomph to bulls.

- Gold Weekly Forecast: XAU/USD snaps three-week winning streak, looks to test $1,760

Sell in May and go away? The adage about stock markets seems irrelevant to gold – at least not on the first day of May 2021. XAU/USD has been staging a substantial move higher, climbing from the bottom of $1,765 to $1,790.50 at the time of writing.

The precious metal – which has no yield – remains highly correlated with returns on US Treasuries. The benchmark 10-year bond yield has dropped to 1.62%, dragging the dollar with it and boosting gold. Markets are content with the Federal Reserve’s dovish approach and the ongoing printing of dollars is a bullish factor for XAU/USD.

Nonfarm Payroll figures for April will likely be the main mover for markets, and nervous moves toward that event are set to trigger high volatility.

Gold Technical Analysis

Gold is benefitting from upside momentum on the four-hour chart, while the Relative Strength Index (RSI) is still below 70. XAU/USD bounced off the 100 Simple Moving Average (SMA) and pierced the 50 SMA on its way up. Another milestone is the move above $1,789 that was a sing high earlier on.

The next critical level to watch is $1,797, which held the yellow metal down in late April. It serves as the last nation before the all-important psychological barrier of $1,800.

Support awaits at $1,769, which was a swing low last week, followed by the late April trough of $1,756.