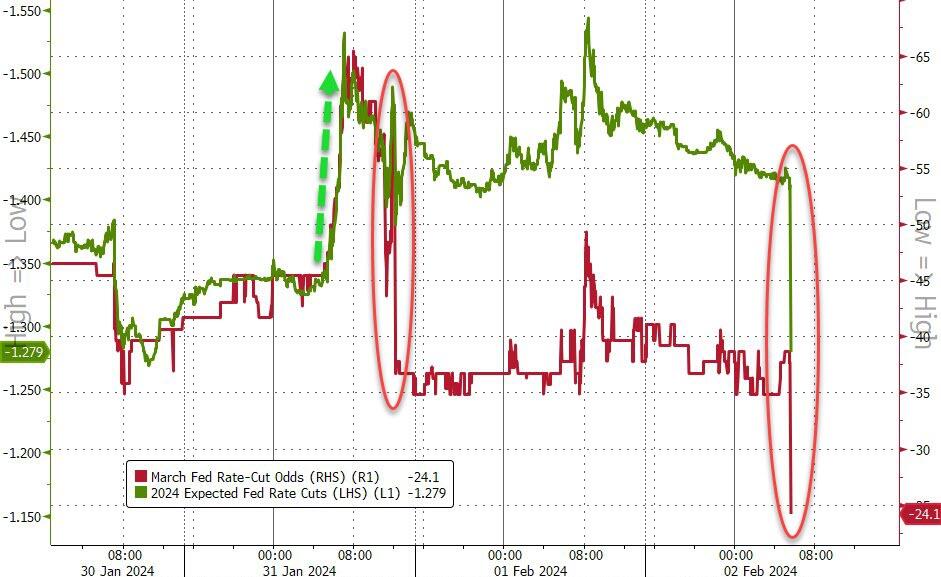

The massive beat for payrolls, and resurgence in average hourly earnings, prompted a sharp response from markets with the dollar spiking, along with bond yields, as gold and the yield curve tumbled, as rate-cut expectations plunged…A March cut is now priced at around 25% and 2024 cut expectations have dropped to 125bps… Source: BloombergThe dollar spiked back to unchanged on the week…

Source: BloombergThe dollar spiked back to unchanged on the week… Source: BloombergTreasury yields soared, led by the short-end…

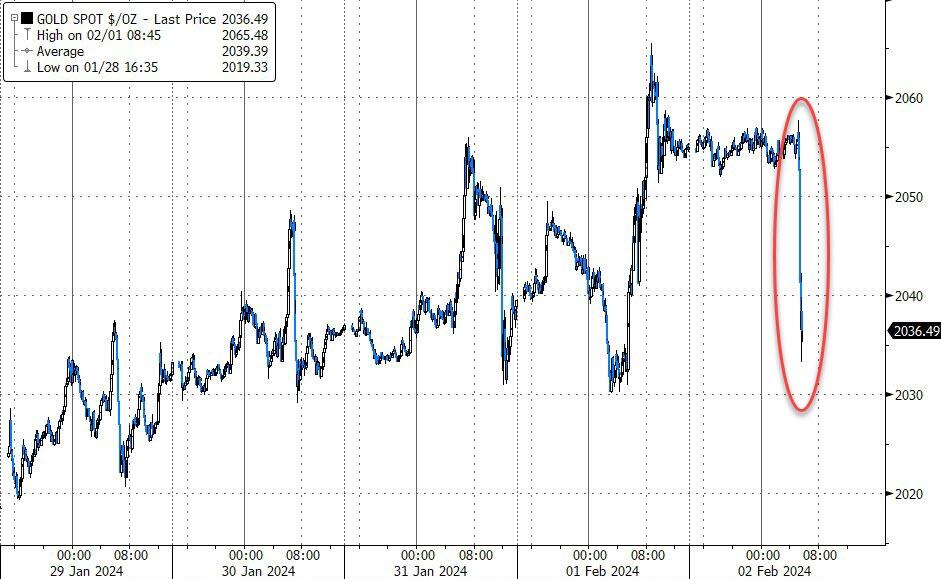

Source: BloombergTreasury yields soared, led by the short-end… Source: BloombergGold dumped…

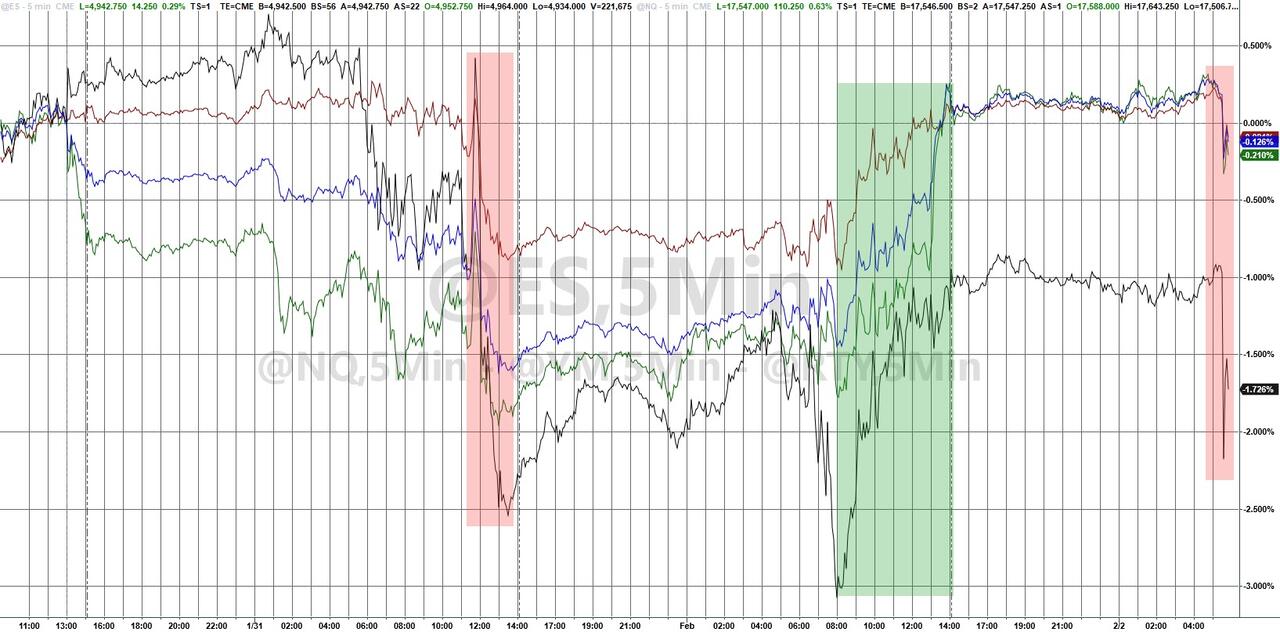

Source: BloombergGold dumped… Source: BloombergAnd finally, all the US major equity markets are tumbling, led by Small Caps, back into the red from before the FOMC…

Source: BloombergAnd finally, all the US major equity markets are tumbling, led by Small Caps, back into the red from before the FOMC… Now we all wait to see what Powell says on 60 Minutes…More By This Author:World’s Largest Uranium Producer Warns Of Production WoesGM Shifting From EVs To Plug-In Hybrids, Following Industry TrendsApple Slides On Plunging China Sales, Service Revenue Miss, Disappointing Guidance

Now we all wait to see what Powell says on 60 Minutes…More By This Author:World’s Largest Uranium Producer Warns Of Production WoesGM Shifting From EVs To Plug-In Hybrids, Following Industry TrendsApple Slides On Plunging China Sales, Service Revenue Miss, Disappointing Guidance

Gold & Bonds Dump, Dollar Jumps As Payrolls Spark Plunge In Rate-Cut Hopes