Global markets begin the last full week of trading of the year in subdued fashion, with U.S. equity futures rising 0.1%, to 2,258.5, European shares decline halting two straight weeks of gains, and Asian shares hitting a four-week low. The Dollar extends losses, yen and gold rise amid geopolitical concerns as the fallout from China’s seizure of a U.S. continues to reverberate. Volumes are thinning before the December holiday season and end of the year, with trading in German bund futures about half the average for the past five days. The Bank of Japan’s policy decision on Tuesday is the last Group of Seven central bank meeting for 2016.

Top overnight news stories include Fairfax agreeing to buy insurer Allied World for $4.9b, Danone warning on lower sales, Aramco IPO possibly still happening in U.S., Disney’s ‘Rogue One’ posting the second-biggest December opening weekend ever.

“As we enter the Christmas, year-end holiday season, volumes could decline and lead to choppy price action. Traders should watch out for higher volatility due to restricted holiday trading volumes,” said Ipek Ozkardeskaya, senior market analyst at London Capital Group

Wall Street hit record highs and the dollar rose to a 14-year peak last week, but investors chose to take some of those chips off the table. The profit-taking spread to Europe, where bank stocks were among the biggest fallers following two weeks of strong gains on the back of rising bond yields. Their decline pushed the broader European indices into the red.

In FX trading, the dollar has retreated against the yen as traders took stock following a six-week rally in the currency. The Stoxx 600 Index edged modestly lower after reaching the highest point of the year on Friday as Banca Monte Paschi tumbled 8.5%, headed for the biggest decline in more than a week ahead of a share issue. The yen strengthened before a Bank of Japan policy review Tuesday, ending a two-day advance in the Nikkei, which was down less than 0.1%. Oil gained, extending a climb from last week amid speculation an increase in maritime tensions could crimp deliveries. Gold headed for the first back-to-back advance in three weeks.

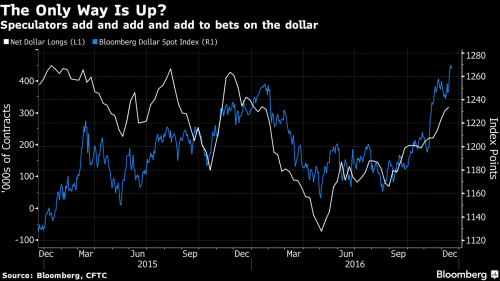

With books for 2016 closing, traders are ready to lock in gains in the greenback, with the Bloomberg Dollar Spot Index heading for its best quarter since 2008 following the election of Donald Trump and the U.S. Federal Reserve’s decision to boost interest rates and signal a steeper path of increases in 2017 last week according to Bloomberg.

“People are pulling in their horns a bit coming into year end and getting ready to reconsider when they come out of holiday period,†said Simon Derrick, chief currency strategist at Bank of New York Mellon Corp. in London. “We have a couple of big events coming up in January and people need to reassess how they think things will play out.â€

MSCI’s broadest index of Asia-Pacific shares outside Japan fell for the third straight day, shedding 0.3 percent to a four-week low. It has lost 3.7 percent since Trump was elected. Investors turned cautious after China’s top leaders said over the weekend they would stem asset bubbles in 2017 and place greater importance on the prevention of financial risk.

The Stoxx Europe 600 Index was down 0.1% in subdued trading, with miners leading declines. In a reversal of the recent rotation into cyclical shares, defensive stocks including utilities, real estate and technology firms rose. The volume of Stoxx 600 shares traded on Monday was almost 30 percent lower than the 30-day average. Banca Monte dei Paschi di Siena fell 8.6% after the lender said it will begin selling shares to institutional investors this week as it aims to complete raising 5 billion euros ($5.2 billion) by the end of the year to avoid a rescue by the Italian government.

In rates, yields on 10-year Treasury notes declined one basis point to 2.58 percent after touching the highest level since September 2014 on Thursday. German bonds were little changed, while yield on Spanish 10-year securities fell three basis points to 1.40 percent.

Meanwhile, China’s bond selloff continued, with 10-year yields rising five basis points to 3.40 percent. The yield surged 25 basis points last week, to 3.35 percent, as hawkish comments from the Federal Reserve and waning liquidity weighed on bond prices.

Of the things to look out for today, Fed Chair Yellen will deliver her final address of the year this evening at 6.30pm GMT when she speaks at the University of Baltimore. The title of her discussion is the state of the job market although given that this is a mid-year commencement address its unlikely that the speech will throw up much new information.

The Bank of Japan started its two-day policy meeting on Monday and is widely expected to hold policy, including its twin targets of minus 0.10 percent interest on a part of excess reserves and the zero percent 10-year government bond yield. No surprises or changes in policy are expected, but given that a potentially big theme for next year is whether the BoJ’s yield cap is tested by the market, it’s still worth listening out for any interesting comments from Governor Kuroda in the press conference that follows.

* * *

Bulletin Headline Summary from RanSquawk

- European equities and fixed income markets have seen a tentative start to the week as markets begin to wind down for the festive break

- Markets descend into consolidation mode, but FX markets will be more reactive than anything else

- Today’s highlights include US Services PM! and comments from Fed Chair Yellen

Market Snapshot

- S&P 500 futures up 0.1% to 2258

- Stoxx 600 down 0.2% to 359

- FTSE 100 down 0.2% to 6998

- DAX down less than 0.1% to 11402

- German 10Yr yield up less than 1bp to 0.32%

- Italian 10Yr yield down 3bps to 1.84%

- Spanish 10Yr yield down 3bps to 1.4%

- S&P GSCI Index down less than 0.1% to 393.5

- MSCI Asia Pacific down less than 0.1% to 136

- Nikkei 225 down less than 0.1% to 19392

- Hang Seng down 0.9% to 21833

- Shanghai Composite down 0.2% to 3118

- S&P/ASX 200 up 0.5% to 5562

- US 10-yr yield down 1bp to 2.58%

- Dollar Index down 0.08% to 102.87

- WTI Crude futures up 0.3% to $52.07

- Brent Futures up 0.3% to $55.38

- Gold spot up 0.2% to $1,137

- Silver spot down 0.3% to $16.04