Stocks across the board, and US equity futures are broadly in the green this morning as markets shrug off the terror-related events in the NYC area over the weekend. There wasn’t a single positive “reason†for the green price action but the bond “tantrum†that caught the attention of stocks beginning back on 9/8 is increasingly fading and investors are hopeful this week’s central bank decisions (BOJ and FOMC both on Wed 9/21) will further ease yield anxieties.

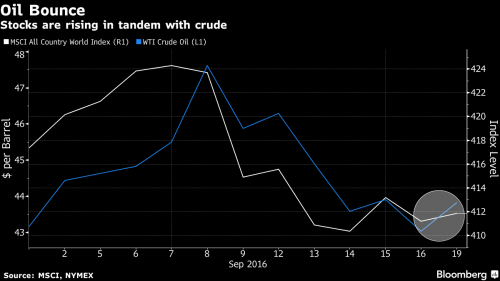

One of the catalysts for the rebound in stocks was today’s rise in oil, which rebounded from Friday’s lows as renewed clashes halted what would be the first crude shipment from one of Libya’s largest export terminals since 2014. The tanker Seadelta suspended loading after fighting started Sunday between local Petroleum Facilities Guard units and forces loyal to eastern-based military commander Khalifa Haftar. Brent added 1.3 percent to $46.36. OPEC may call an extraordinary meeting if ministers reach consensus at an informal gathering next week, Secretary General Mohammed Barkindo said, according to Algerian Press Service.

“Sentiment is being boosted by a rebound in oil,†Vasu Menon, VP at Oversea-Chinese Banking Corp. in Singapore told Bloomberg. “Investors are also hoping the BOJ will do something more dramatic though I don’t think that’s going to make a lot of difference. With inflation numbers picking up a little bit in the U.S., the market will start worrying about the Fed again at some stage down the road.â€

Major oil producers will meet next week in Algiers to discuss cooperating to shore up prices amid a global oversupply that has hurt state budgets. Before that, the Bank of Japan will undertake a review of its monetary policy and the Federal Reserve will meet to determine whether to raise rates. Volatility has picked up in financial markets over the past two weeks amid concern central banks are becoming reluctant to loosen monetary policy, while at least three bombs discovered in New York and New Jersey over the weekend may increase political turmoil.

The MSCI All-Country World Index climbed 0.4 percent at 11:16 a.m. in London as U.S. crude added 1.6 percent to $43.73 a barrel. The Bloomberg Dollar Spot Index declined 0.3 percent.

The Stoxx Europe 600 Index climbed 0.9% after its biggest weekly slide in three months. Rio Tinto Group (RIO) and BHP Billiton Ltd. (BHP) rose at least 2.8 percent, contributing the most to gains among miners. Total SA (TOT) and BP Plc (BP) were among those that led oil-related stocks higher. Weir Group Plc added 3.1 percent after JPMorgan Chase & Co. recommended buying shares of the maker of fracking pumps for oil companies, citing improving prospects. U.K. builders gained, with Barratt Development Plc and Berkeley Group Holdings Plc adding 1.2 percent or more, as a report showed London house prices rebounded from their post-Brexit drop in September. HSBC Holdings Plc was among banks that gained the most. Deutsche Bank AG, which sparked a selloff on Friday after rebuffing a U.S. Justice Department claim to settle a probe tied to mortgage-backed securities, bucked the trend on Monday, with a 0.3 percent drop.Â

Emerging-market shares and currencies rallied with developed markets, led by a 2.8 percent gain in Taiwan’s Taiex Index and a 0.8 percent advance in Taiwan’s dollar. HTC surged 10 percent in Taiwan, the biggest gain since May 25, on reports the company will unveil a new mobile-phone handset.

S&P 500 Index (SPY) futures added 0.5%, indicating U.S. equities will recover from Friday’s 0.4 percent retreat.

The yield on Treasuries due in a decade was little changed at 1.69 percent. It erased a three basis point decline on Friday following the release of the American inflation data, which boosted the probability of an interest-rate hike this year by five percentage points in the futures market to 55 percent. Spanish and Italian securities led gains in Europe. The yield on 10-year Spanish bonds slipped three basis points to 1.05 percent, while that on similar-maturity Italian debt fell two basis points to 1.32 percent, after adding nine basis points last week. Portugal’s 10-year bond yield was steady at 3.39 percent, after surging 26 basis points last week. The nation’s debt rating was affirmed on Friday by S&P, which forecast the economy will lose momentum this year.

Market Wrap

- S&P 500 futures up 0.5% to 2142

- Stoxx 600 up 1% to 341

- FTSE 100 up 1.5% to 6810

- DAX up 0.8% to 10357

- German 10Yr yield up less than 1bp to 0.01%

- Italian 10Yr yield down 1bp to 1.33%

- Spanish 10Yr yield down 2bps to 1.06%

- S&P GSCI Index up 0.8% to 350.7

- MSCI Asia Pacific up 0.9% to 138

- Hang Seng up 0.9% to 23550

- Shanghai Composite up 0.8% to 3026

- S&P/ASX 200 down less than 0.1% to 5295

- US 10-yr yield up less than 1bp to 1.69%

- Dollar Index down 0.27% to 95.85

- WTI Crude futures up 1.5% to $43.69

- Brent Futures up 1.2% to $46.33

- Gold spot up 0.4% to $1,316

- Silver spot up 1.7% to $19.13

Global Headline News

- More Guns to Greet New York as Another Suspicious Package Found: 1,000 more police blanket NYC, videos of Chelsea street sought

- Stiglitz Grades Trump F on Economics, Cites China Trade Risk: Nobelist says more American jobs would be lost than created

- Market Resilience Post-Brexit Masks Underlying Risks, BIS Says: Rally in stocks as bond yields plunged signals ‘dissonance’

- EU’s Vestager Signals Apple Just the Start of U.S. Tax Probes: Competition chief will meet in Washington with Lew, lawmakers

- Merkel Dealt Berlin Defeat With Worst Result Since World War II: Voters punish two biggest German parties in capital city vote

- U.K. Business Confidence Drops to Four-Year Low, Lloyds Says: Economic uncertainty, U.K. demand seen as biggest threats, according to Lloyds’ Business in Britain report

- Global Investors Bet $7.3b on Australia’s No. 1 Port: Port of Melbourne handles 2.6m containers a year

- Saudi Telecom Said to Mull Options for Stake in Malaysia’s Maxis: Gulf carrier owns indirect holding valued at $1.8b

- Noble Group Eyes Investor as Profit Seen Up to 2 Years Away: Strategic partner ‘still very possible,’ founder Elman says

- Oracle’s (ORCL) Ellison Takes Shot at Amazon (AMZN) With New Cloud Services: co. unveiled new services that help customers take advantage of cloud computing

- Oracle Buys Palerra to Boost ‘Security Stack’: TechCrunch: Terms weren’t disclosed, TechCrunch reports