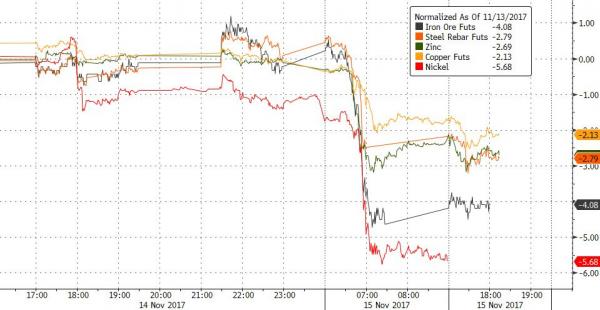

The euphoria of the past month has ended with a thud and BTFDers are strangely missing as the commodity chill out of China (which overnight became full blown carnage), has unleashed a global risk-off phase ahead of today’s critical CPI data, resulting in broad and sharp selling across global markets, as European stocks followed declines in Asia while bonds and gold advanced. The equity retreat, which spread to U.S. stock futures, started with full blown carnage.

As a result, S&P 500 futures dropped 0.5% after U.S. stocks fell for a third time in four days, while Japan’s recent euphoria – which attracted a record influx of foreign investors – is now a distant memory with the Topix falling for the fifth day, its longest losing streak this year, as it declined 2%, while European stocks tumbled for a seventh consecutive day, the worst losing streak since November 2016, to a two month low with the Stoxx 600 down 1%.

“The decline by U.S. equities led by energy shares is having a knock-on effect, dampening sentiment in sectors related to energy and industry,†said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management in Tokyo. “Broadly speaking equities had enjoyed an almost uninterrupted run for the past few months, so we are seeing a bit of a correction finally emerging.â€

“So far we don’t see that much disruption in sentiment, so I think we are just taking a bit of froth off the top of the market at the moment,†Michael Metcalfe, global head of macro strategy at State Street Global Markets, said on Bloomberg TV. “It would be dangerous to say this is the unwinding of a bubble – the fact that it’s being led by Japan actually tells you that, because there isn’t a valuation case to sell Japanese stocks.â€

The cautious tone has settled into markets in recent days as new obstacles emerged to the U.S. overhauling taxes and after many stock gauges approached record highs. Attention now turns to data coming on U.S. consumer prices and retail sales for further clues on US economic strength after the flattest American yield curve in a decade raised concern that growth will slow. Amusingoy, amid the equity pullback, Morgan Stanley advised staying overweight stocks and avoiding the temptation to sell even as valuations appear stretched. Current indicators used by the New York-based bank’s cross-asset strategy team are showing strong macro-economic data favoring a tilt to shares, with low allocation to high-yield credit.

Asian equities fell, with the regional benchmark poised for its steepest four-day decline this year, as a slump in commodity prices weighed on materials and energy producers shares. The MSCI Asia Pacific Index dropped 1% percent to 167.97 with material and energy sub-gauges each down at least 1.7 percent. Japan’s Topix capped its longest declining streak since September 2016, while Hong Kong’s Hang Seng Index lost 1 percent. Moderation in China’s growth and rising odds of U.S. rate hikes are putting the brakes on Asia’s world-leading rally this year. A Bloomberg gauge of commodity prices extended Tuesday’s steepest slump in six months after Chinese data pointed to slowing industrial output, fixed-asset investment and retail sales. The MSCI Emerging Market Index fell 0.4%, hitting the lowest in almost three weeks with its fifth consecutive decline.

“Commodity prices are sinking on rate-hike expectations as well as China data that missed some analyst forecasts,” said Hao Hong, Hong Kong-based chief strategist at Bocom International Holdings Co. “Investors are taking profits after rallies.” Mitsubishi Gas Chemical Co. slumped 4.3 percent in Tokyo for its biggest drop in more than seven months, while PetroChina Co. lost 3.1 percent in Hong Kong.

European stocks followed in Asia’s example, falling in brisk volumes, with basic resources and energy stocks falling the most on the back of weaker commodity prices, as investors assess the global equity pull-back. The Stoxx Europe 600 Index retreated 0.6% to a near two-month low, breaking below its 200-day moving average for the first time since early September. All but one sector are in the red, with banks among the worst performers as bond yields weaken. The Stoxx 600 is heading for its longest losing streak since November 2016. The U.K.’s FTSE 100 Index decreased 0.6% , hitting the lowest in almost seven weeks with its fifth consecutive decline. Germany’s DAX Index dipped 1.3%, reaching the lowest in almost seven weeks on its fifth consecutive decline.

European stocks fall in brisk volumes, with basic resources and energy stocks falling the most on the back of weaker commodity prices, as investors assess the global equity pull-back. The Stoxx Europe 600 Index retreats 0.6% to a near two-month low, breaking below its 200-day moving average for the first time since early September. All but one sector are in the red, with banks among the worst performers as bond yields weaken. The Stoxx 600 is heading for its longest losing streak since November 2016. Mining and oil-related stocks set the tone, as the Bloomberg Commodities Index continued its longest slide since June.

Benchmark WTI crude fell through $55 a barrel after industry data showed U.S. stockpiles unexpectedly rose last week and as Russia was said to waver on extending output cuts. The dollar traded near a three-week low and Treasuries led bond gains. S&P 500 futures dropped 0.6 percent.

The euro climbed to its highest level in more than three weeks, the EURUSD rising above 1.1800 as increased confidence in the currency bloc was underpinned with concerns that U.S. inflation data due Wednesday may further pressure the dollar. The common currency rose a sixth day, set for its longest winning run since May 2016, as demand for upside exposure intensified in both spot and options markets. Real-money names returned from the sidelines and added fresh longs, while macro accounts also bid the euro, traders in Europe and London told Bloomberg.

Pressured by the euro’s surge, the dollar index against a basket of six major currencies lost about 0.7 percent overnight. It last stood flat at 93.870. The greenback was 0.2 percent lower at 113.230 yen after pulling back from a high of 113.910 the previous day.The yen as well as Japan’s equity and bond markets showed little reaction to Wednesday’s GDP data. Japan’s economy grew for the seventh straight quarter during the July-September period, although this was tempered somewhat as private consumption declined for the first time since the last quarter of 2015.

The immediate focus for the dollar, and a potential catalyst, was data on U.S. consumer prices due later in the global day.

Ahead of today’s closely watched CPI update out of the US, overnight the Fed’s Evans said that the Fed should acknowledge a much greater chance of 2.5% inflation, further stating that he sees solid US economic growth in 2018 and sees a big risk in not getting inflation to 2% before the next recession hits.

Elsewhere, the US Senate Finance Committee Chair Hatch unveiled the modified Chairman’s mark of Senate’s tax overhaul plan, which:

- Repeals Affordable Care Act’s individual mandate tax, according to release from committee

- Increases child tax credit from the current $1,000 to $2,000

- Reduces middle income tax rates from 22.5% to 22%; 25% to 24%; and 32.5% to 32%

The White House is said to strongly support the House tax bill.