European shares advanced, with gains in automakers helping Germany’s benchmark DAX Index turn positive for the year for the first time. Stocks rose around the world, led by emerging-markets, as oil climbed further after its best week since April and traders pushed back bets on higher U.S. interest rates. S&P futures advance and Asian stocks little changed as rising oil prices bolstered investor sentiment. That said, volumes are even more lethargic than usual as peak vacation season hits, and the volume for the Stoxx 600 is 70% below average with much of Europe on official holiday due to Assumption day.

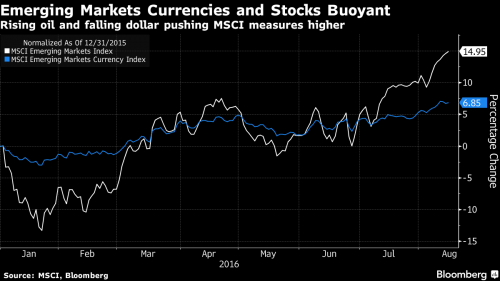

While Developed Markets have been sleepy, the MSCI Emerging Markets Index climbed to the highest level in more than a year, with Chinese equities rallying the most since May on speculation of more property takeovers. The MSCI emerging markets gauge rose 0.4% at 10:24 a.m. in London, gaining for an eighth day to the highest since July 2015. The ruble strengthened as oil extended gains on speculation that producers will revive talks to stabilize prices. European shares rose modestly, pushing Germany’s DAX into the green YTD for the year for the first time. Helping EMs, the Bloomberg Dollar Spot Index declined for a second day.

Continued expectations of easy monetary policies, meant that global equities are trading near a one-year high as evidence of uneven growth in the world’s biggest economies fuels optimism that central banks will come to the rescue by way of additional stimulus and looser monetary policy. The probability that the Federal Reserve will increase interest rates this year eased to 42% in the futures market on Friday following the release of the disappointing U.S. retail sales figures, from 49% a day earlier.

“Interest rates will stay low and the dollar should be quite stable,†said Hertta Alava, the head of emerging markets at FIM Asset Management Ltd. in Helsinki. “That is supportive for emerging-market currencies. The oil price recovery is supportive for sentiment too.â€

Oil prices rebounded in early trading, forcing more shorts to cover after comments by the Russian Energy Minister Novak who stated that Russia are consulting with Saudi Arabia, other countries to achieve oil market stability. However, the initial euphoria has fizzled and oil was largely unchanged at last check.

Among other notable overnight movers, in addition to the ongoing strength in EMs indices, now up for an 8th consecutive day, China’s Shanghai Composite jumped 2.4% as a measure of real estate companies had its steepest two-day rally in almost a year after stake purchases by China Evergrande Group fueled optimism of more mergers.The Stoxx Europe 600 Index added 0.1%, with volume 70 percent lower than the 30-day average for the time of day.

The DAX Index rose as much as 0.8%. Volkswagen added 1.4 percent, helping automakers to a rebound from Friday’s decline to post the best performance of the 19 industry groups on the Stoxx 600. Statoil ASA was among the best-performing oil stocks as crude extended its advance above $44 a barrel. Glencore Plc dragged raw material producers lower. Hennes & Mauritz AB advanced 1.9 percent after reporting a better-than-expected 10 percent increase in July sales.

S&P 500 Index futures advanced 0.2%, after U.S. equities slipped from their highs on Friday following disappointing retail sales and consumer confidence data. Later today, the latest NY Fed “Empire Manufacturing” report is expected to rise modestly by 2, after last month’s 0.55 print.

Market Snapshot

- S&P 500 futures up 0.2% to 2184

- Stoxx 600 up 0.2% to 347

- FTSE 100 up 0.2% to 6929

- DAX up 0.3% to 10742

- German 10Yr yieldunchanged at -0.11%

- Italian 10Yr yield down less than 1bp to 1.04%

- Spanish 10Yr yield down less than 1bp to 0.92%

- S&P GSCI Index up 0.3% to 354.3

- MSCI Asia Pacific down less than 0.1% to 140

- Nikkei 225 down 0.3% to 16870

- Hang Seng up 0.7% to 22933

- Shanghai Composite up 2.4% to 3125

- S&P/ASX 200 up 0.2% to 5540

- US 10-yr yield down 1bp to 1.5%

- Dollar Index down 0.08% to 95.65

- WTI Crude futures up 1.3% to $45.08

- Brent Futures up 1.1% to $47.51

- Gold spot up 0.4% to $1,342

- Silver spot up 0.8% to $19.87

Top Global Headline News

- Here comes the Brexit-era British economy in hard numbers; inflation, retail sales, jobs may show how vote impacted U.K.

- Londoners cut house prices to lure buyers in slowing market

- British millennials are ‘collateral damage’ as pension gap grows; younger workers will have to save more or work for longer

- Hedge funds make record bearish pound bets on Brexit pessimism

- Loonie breaks from oil as bears shift focus to economic woes

- Yuan tumbles most in six weeks as data reignite economy concerns

- Honeywell (HON) to Buy JDA Software for $3 Billion, WSJ Says; The transaction could be announced as soon as Monday

- Entertainment One Gains as KKR Weighs Bid to Top ITV’s Proposal; KKR emerged as a potential bidder for the film and television distributor, which rejected a proposal by broadcaster ITV Plc last week.

- Noble Group’s Liquidity Crunch to Be ‘Temporary,’ Fitch Says: The demphasis on scale to remain until NAES sale, agency says. So-called liquidity ratio seen rising back above level of 1

- AngloGold Says Dividends May Return Next Year as Cash Flow Rises: Bullion miner’s board will debate new dividend policy. First-half cash flow tripled to $108 million on higher prices

- Treasuries Fall Behind Company Debt as Pimco Pursues Credit: Corporate bond spread over Treasuries is smallest in a year. Pimco’s Kiesel sees significant opportunity in corporate debt

- World’s Biggest Shipping Firm Warns Against U.S. Protectionism: Maersk, a Danish conglomerate that owns the world’s largest container shipping company, is voicing concern as a potential shift in U.S. policy threatens to reduce global trade.