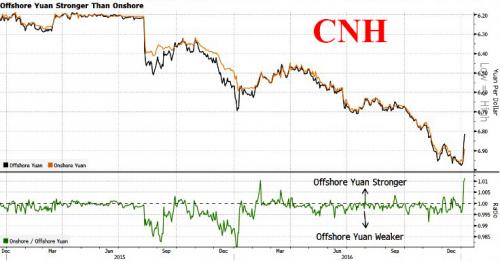

Asian stocks rose, led by Hong Kong, while European shares and U.S. equity-index futures are little changed. Euro, yen climb as the dollar posted an unexpected loss following some serious fireworks out of China, which intervened in funding market to crush offshore Yuan shorts.

Top news stories include Macy’s (M) and Kohl’s (KSS) cutting their outlook after weak holiday season, Deutsche Bank (DB) exploring lending money to PE firms buying distressed loans, Apple (APPL) planning to invest $1b in SoftBank’s new technology fund.

Declines in the USD outweighed major peers in the past week as traders interpreted minutes from the last Fed meeting to indicate a slower path to interest-rate increases, boosting demand for bonds and assets of developing nations. The offshore yuan surged the most on record after the government encouraged companies to stock up on the currency before the week of lunar New Year celebrations.

Gold climbed to the highest in a month.

As Bloomberg notes, the growing backlash against the dollar coincides with more-sober outlooks on whether President-elect Donald Trump’s plans to boost fiscal spending will achieve rapid reflation. The Fed reiterated that a “gradual†pace of rate hikes over the coming years would likely remain appropriate, damping speculation officials will step in to counter inflation with higher rates. Stocks have rallied with the dollar, while Treasuries have plunged since Trump’s election.

While the Dow continues to flirt with 20,000, world stocks hit their highest level since mid-2015 on Thursday after strong Chinese data added to the optimism about global growth and inflation that has been driving markets since the start of the new year. The MSCI world equity index was up 0.4% at one stage to hit its highest level since July 2015. At that level it was up over 1.5 percent for the year so far. The index was pushed up by Asian shares, which rose for the eighth consecutive day on Thursday .

Growth in China’s services sector accelerated to a 17-month high in December, a private sector survey showed, adding to upbeat factory and service sector surveys out of the United States, Europe and Asia released this week.

In addition, minutes from the U.S. Federal Reserve’s December meeting showed that many of the central bank’s policy makers are expecting a pick-up in economic growth and inflation in the world’s biggest economy as a result of fiscal, regulatory or other policies, although most expressed concern that the pace of Trump fiscal stimuli could end up overpowering the economy, and pushing inflation (and the dollar) too high.

“Recent economic data is pretty good so markets are in risk-on mode overall,” said Yukio Ishizuki, currency strategist at Daiwa Securities. “But U.S. bond yields are being capped so the dollar is losing the driver behind its rally.”

Stocks and bond yields have been rising ever since the election of Republican Donald Trump as U.S. president on expectations that fiscal stimulus will boost growth and inflation. Trump’s inauguration takes place on Jan. 20. “The FOMC’s minutes to its Dec meeting released post yesterday’s European close could best be characterized as perhaps tilted toward the hawkish side but tempered by a heavy dose of uncertainty,” said Rabobank strategist Richard McGuire. “All the policymakers emphasized the uncertainty of the outlook, reminding investors that the outlook is more nuanced than the market seems to think,” he said.

With just two weeks to go before Trump takes over, investors and policymakers are waiting to see if his actions match his rhetoric and if his policies will be approved by Republican lawmakers. The dollar extended its losses on Thursday, falling 0.42% against a basket of six major currencies – though still near the 14-year high hit on Tuesday – following losses against the Chinese yuan, which soared after Beijing stepped into both its onshore and offshore yuan markets to shore up the faltering yuan for a second day on Wednesday, sparking speculation that it wants a firm grip on the currency ahead of Trump’s inauguration.

“In the past two months it’s really been the U.S. versus the rest of the world,†said Simon Quijano-Evans, a strategist at Legal & General Group Plc in London. “Maybe there will be some wind taken out of the sails. As we move towards the end of January and the lunar new year holidays, the Chinese authorities are being overly cautious to prevent a rout.â€

Maybe, but not today as the DJIA is about to try once again to cross the long-awaited 20,000 barrier.

* * *

Markets Snapshot

- S&P 500 futures down less than 0.1% to 2264

- Stoxx 600 down less than 0.1% to 365

- FTSE 100 down less than 0.1% to 7186

- DAX down 0.2% to 11560

- German 10Yr yield up less than 1bp to 0.28%

- Italian 10Yr yield up 4bps to 1.91%

- Spanish 10Yr yield up 5bps to 1.48%

- S&P GSCI Index down less than 0.1% to 396

- MSCI Asia Pacific up 1% to 138

- Nikkei 225 down 0.4% to 19521

- Hang Seng up 1.5% to 22457

- Shanghai Composite up 0.2% to 3165

- S&P/ASX 200 up 0.3% to 5753

- US 10-yr yield down less than 1bp to 2.43%

- Dollar Index down 0.42% to 102.27

- WTI Crude futures down less than 0.1% to $53.25

- Brent Futures down less than 0.1% to $56.41

- Gold spot up 0.8% to $1,173

- Silver spot up 1% to $16.60