European and Asian markets rose, while U.S. index futures were little changed, with the Dow Jones Industrial Average pushing for yet another record, as traders digested the Italian referendum news, await the ECB’s Thursday announcement and reflect in a notably quieter overnight session. Oil slipped from a 16-month high after 4 straight days of gains, as doubts emerged about how OPEC will implement the first supply curbs in eight years. European bonds gained with stocks.

The euro held firm on Tuesday, having seen a wild 3-cent swing in the wake of Italy’s referendum, while the region’s bond yields dipped in line with U.S. peers as oil saw its first fall for five days. Asian stocks saw their strongest day for 2 weeks overnight after Wall Street’s Dow Jones index hit a record high, and Europe’s main bourses struggled into positive territory as bumper German data helped settle an early wobble.

As concerns about Italy subsided for the time being, Italian bond yields were back below levels seen before Sunday’s referendum defeat for the government, while the euro held at $1.0767 having bounced strongly from as low as $1.0505 on Monday, two days ahead of an ECB decision in which Mario Draghi is expected to extend QE by 6 months with little other adjustments.”The referendum result could put the ECB under pressure not to taper the asset purchase program but to extend it for six months beyond March (in its current form),” ING strategist Benjamin Schroeder said.

European shares rose on news that German industrial orders soared at the fastest pace for more than two years, stoking hopes that Europe’s largest economy is set for an acceleration in the coming months.Factories saw demand climb 4.9 percent on the month despite bulk orders being lower than usual, the German economy ministry said. That was the biggest increase since July 2014 and far above the Reuters consensus forecast for a 0.6 percent rise.”The reading was very strong even without large-scale orders and that suggests it’s more than just a flash in the pan,” BayernLB economist Stefan Kipar said, noting that some firms might have brought orders forward.

The Stoxx Europe 600 Index gained 0.3%, adding to its 0.6% advance from Monday. Italy’s FTSE MIB Index gained ground, up 1.3%, helped by gains of more than 3 percent each by UniCredit SpA and Mediobanca SpA. Stoxx 600 energy producers tracked declines in oil prices, which retreated from the highest close in 16 months. The MSCI Emerging Markets Index jumped 0.9 percent.Financial shares in China weakened again, however, after the country’s insurance regulator suspended an unlisted firm from selling some products a day after a warning about “barbaric” share acquisitions by asset managers.

In emerging markets, Turkey, where the lira has slumped to record lows in recent weeks, saw a warning from the head of the central bank that the weakness could cause the bank to miss its inflation targets early next year. In Asia, gold nudged off a 10-month low. MSCI’s broadest index for the region bounced 0.7 percent, its biggest daily rise since Nov. 22, as Korea climbed 1.4 percent and Japan rose 0.4 percent. The Australian dollar led declines among major economies, falling 0.5 percent to 74.38 U.S. cents, after the nation’s central bank central bank kept interest rates unchanged and Governor Philip Lowe said “some slowing in the year-ended growth rate is likely.â€

In an otherwise quiet session, where E-minis are currently unchanged before Tuesday’s release of factory and durable goods orders, which may confirm the U.S. economy is gaining strength and giving the Federal Reserve more reason to raise interest rates, and after the Dow Average swung back to gains Monday, increasing 0.2 percent to an all-time high, early trader focus was on crude.

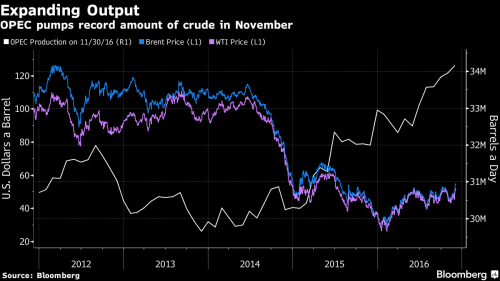

Ending a 4-day winning streak, oil prices slipped on Tuesday as crude output rose in virtually every major export region despite plans by OPEC and Russia to cut production, triggering fears that a fuel glut that has dogged markets for over two years might last well into 2017. Brent futures were trading at $54.64 per barrel at 0935 GMT, down 30 cents from Monday’s close; WTI was at $51.39 a barrel, down 40 cents. Traders and analysts cited by Reuters said the boost from last week’s decision by OPEC to cut crude production had faded and the cartel’s promise had been undermined by data showing rising production from within its member countries and Russia.

“Most of the position adjustments that the OPEC decision forced upon traders have now run their course and it leaves the market exposed to profit taking,” said Ole Hansen, head of commodities strategy at Saxo Bank, citing surveys pointing to record production from OPEC during November. “What’s troubling is that the rise is coming from African producers, two of which are exempt from cutting production,” he said. “The meeting on Saturday between OPEC and non-OPEC producers will be crucial in order to maintain the bullish sentiment seen since last Wednesday.” OPEC’s oil output set another record high in November, rising to 34.19 million barrels per day (bpd) from 33.82 million bpd in October, according to a Reuters survey based on shipping data and information from industry sources.

“It’s a headache for OPEC in terms of increase in production for Libya and Nigeria, definitely that’s a tricky part,†said Bjarne Schieldrop, chief commodities analyst at SEB Markets. “A lot of buying went on following the OPEC decision and now it’s sort of taking it quietly.â€

In rates, Italy’s 10-year bond yield declined six basis points to 1.93 percent, almost erasing Monday’s increase of eight basis points. Yields on Portugal’s bonds with a similar due date decreased nine basis points to 3.61 percent, while Germany’s rose one basis point to 0.34 percent. Almost all economists surveyed by Bloomberg expect the ECB to announce on Thursday that its bond-buying program will be extended after March, and most foresee an extension of about six months at the current 80 billion euros ($85 billion) a month. Treasury 10-year yields were little changed at 2.39%.