Traders are still stunned by the dramatic move in risk assets during yesterday’s US session. As a reminder, at the lows for the day in the mid-morning Eastern Time, we saw the DAX at -1.81%, FTSE -1.13%, S&P 500 -1.03%, US 10y yield 1.516% (lowest since August 2012) and GBPUSD 1.401. By the various closes these rallied to -0.59%, -0.27%, +0.31%, 1.580% and 1.420 respectively.

What changed?

Unfortunately it had everything to do with the death of Jo Cox, which as even Deutsche Bank admits, “while it seems insensitive to talk about markets in relation to this event, unfortunately this story heavily influenced them yesterday. Before this news came out the two phone polls that the market had been waiting for both came out in favour of ‘leave’ (Ipsos-Mori 53%/47% and Survation 45%/42%).” The reason: BBC eyewitness reports (later questioned) suggesting the killer shouted ‘put Britain first’. As a result, campaigning has been suspended for now and it’s unclear when it will get going again. As we first noted, the immediate outcome of the shooting was a rumor that the Brexit vote next Thursday will be postponed, which in turn boosted “Remains” odds.

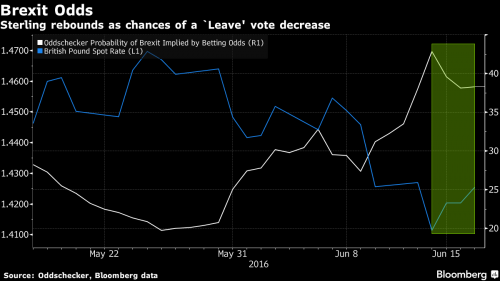

And, as Bloomberg also puts it, “Sterling rebounded from a two-month low as an opinion poll on voter intentions in next week’s referendum was delayed.“

Odds on the U.K. leaving the EU slid to 38 percent after hitting a record 44 percent on Thursday, according to Oddschecker calculations based on bookmakers’ quotes. “If you do see uncertainty, that typically will drive voters to the status quo,†said Karl Schamotta, director of foreign-exchange research and strategy in Toronto at Cambridge Global Payments, which hedges currencies for companies. “We’re seeing a trade that’s entirely too crowded — at the end of the day, the market expectation remains that we will see a stay vote.â€

In short, as Bloomberg, DB and Reuters all admit, the tragic death of Jo Cox had a morbidly levitating effect on all risk assets.  “The halt in campaigning may just take Brexit off the headlines momentarily, and that may have given an opportunity to just to see a little bit of a retracement in a comparatively quieter environment,â€Â said Orlando Green, a rates strategist at Credit Agricole SA’s corporate and investment-banking unit in London. “We’ll see a choppy environment as we head toward the referendum.â€

Ten-year bonds in Japan and the U.K. declined for the first time in more than a week. Global stocks rebounded from a four-week low and commodities advanced with the pound as campaigning in Britain’s referendum on European Union membership was suspended for a second day. Oil rose, paring its biggest weekly decline in more than two months.Â

German bonds fell for the first time in four days, ending a three-day rally that pushed the yield into negative territory for the first time. The yield was near-zero, from minus 0.02 percent on Thursday. Similar-maturity U.K. debt snapped an eight-day run of gains. Spanish and Italian debt rallied as investors snapped up higher-yielding assets.

Japan’s 10-year bonds fell for the first time in seven days, lifting their yield by five basis points to minus 0.15 percent. It sank to a record minus 0.21 percent in the last session as the BOJ said inflation in the nation may be zero or negative. The rate on similar-maturity bonds in Australia climbed eight basis points to 2.09 percent, after slipping below 2 percent for the first time on Thursday. U.S. Treasuries due in a decade fell, lifting their yield by two basis points to 1.60 percent. It touched 1.52 percent in the last session, the lowest intraday level since August 2012, after the Fed on Wednesday lowered its projections for the path of policy tightening.

As a reminder, it is not just sterling: “With Brexit risks an important driver of currencies in the near term, dollar-yen can track lower next week,†said Joseph Capurso, a senior currency strategist in Sydney at Commonwealth Bank of Australia. “That raises the risk the Ministry of Finance may intervene to stem the recent rapid gains in the yen.†As Shunichi Otsuka, general manager of research and strategy at Ichiyoshi Securities, added “The dollar-yen market has calmed somewhat,†said “We’ll probably see a rebound from the steep fall yesterday. The fact that U.S. shares have risen is also a tailwind for Japanese equities.â€

Meanwhile, while it may very well not last and all of yesterday’s gains could evaporate instantly if David Cameron announces that the Brexit vote will take place as scheduled, while polling remains unchanged from before Jo Cox’s tragic death, all 10 industry groups in the MSCI All-Country World Index advanced, with the index of global equities rising 0.7% trimming the week’s drop 1.6%. The Stoxx Europe 600 Index rose 1.4%. European lenders rallied the most, buoyed by Italian banks. Futures on the S&P 500 were little changed, after equities Thursday snapped their longest losing streak since February.

Meanwhile, the biggest event earlier in the week, the FOMC rate hike decision, is now all but ancient history: the odds of a move on borrowing costs have fallen to 4 percent for July and less than 40 percent for as late as February 2017, after the Federal Reserve this week scaled back its projections for increases.

Global Market Snapshot

- S&P 500 futures down less than 0.1% to 2070

- Stoxx 600 up 1.7% to 327

- FTSE 100 up 1.5% to 6039

- DAX up 1.3% to 9679

- S&P GSCI Index up 0.9% to 371.2

- MSCI Asia Pacific up 0.6% to 126

- Nikkei 225 up 1.1% to 15600

- Hang Seng up 0.7% to 20170

- Shanghai Composite up 0.4% to 2885

- S&P/ASX 200 up 0.3% to 5163

- US 10-yr yield up 3bps to 1.61%

- German 10Yr yield up 3bps to 0.01%

- Italian 10Yr yield down 3bps to 1.51%

- Spanish 10Yr yield down 3bps to 1.57%

- Dollar Index down 0.16% to 94.42

- WTI Crude futures up 1.1% to $46.71

- Brent Futures up 1.6% to $47.93

- Gold spot up 0.5% to $1,285

- Silver spot up 1.1% to $17.39