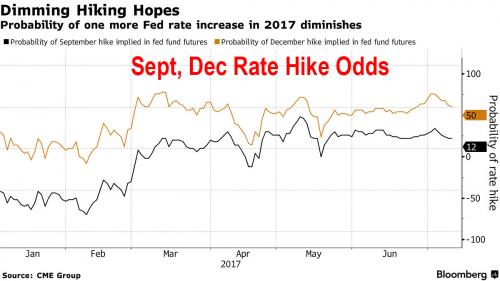

The hawkish tone and global bond tantrum unleashed by central bankers at the Sintra ECB forum two weeks ago is now a distant memory, and after Janet Yellen surprised markets with an unexpectedly dovish (in the market’s interpretation) testimony yesterday, overnight global shares hit their fourth all-time high in less than a month as concerns about the tightening Fed were laid to rest, sending September and December rate hike odds sliding.

One of the Fed chief’s comments that markets latched on to was her view that bank would not need to raise U.S. rates “all that much further” to reach current low estimates of the “neutral” funds rate. Yellen’s dovish relent lifted Wall Street to a new all time high, while lowering bond yields virtually everywhere and sending the MSCI All-Country World Index to a fresh record while European shares headed for their biggest two-day gain in almost three months. Â

Yellen’s testimony had the added impact of diverting attention from Trump Jr.’s emails about his meeting with a Russian lawyer, which sent stocks sliding on Tuesday, though concern remains that the latest saga in Washington will likely delay, perhaps permanently, Trump’s fiscal reform efforts. The dovish Fed also sent the Bloomberg Dollar Spot Index to the lowest since September while gold climbed.

“Dollar positioning is short and yesterday’s testimony just confirmed what the market believed: that the Fed is not going to be able to be as hawkish as they are suggesting,” BofA’s Athanasios Vamvakidis said in a note.

“It mostly seems to be down to Yellen,” Rabobank quantitative analyst Bas Van Geffen told Reuters. “The fact that it seems like the Fed is going to take it slowly is being seen as a good sign by the equity markets and by the currency markets.”

So with much of the debate in the market surrounding Yellen’s comments around inflation, its timely that today we’ll get the June PPI report followed then by the June CPI report tomorrow. With regards to the former, the market consensus is for a 0.0% mom headline reading and a +0.2% mom increase in the core reading. What will be worth keeping an eye on is the health care services component of the PPI which will provide clues on the near-term direction of the core PCE deflator which as we know is the Fed’s preferred inflation metric. Something to look forward to.

Like equities, Treasuries rallied in reaction to Yellen, with yields on two-year notes falling to three-week lows, as did bonds in Europe and Asia. Germany’s benchmark 10-year Bund yield was flat on the day at 0.51 percent. They have now given back a quarter of the rise triggered by last month’s hint from ECB head Mario Draghi that it was readying to scale back stimulus. Treasuries meanwhile have clawed back a third of their selloff.

“The market did perceive a greater degree of anxiety over inflation – at the margin,” said Westpac’s U.S. economist, Elliot Clarke. “To our mind, this is unlikely to get in the way of another hike this year.”

“Two further hikes in 2018 will likely be justified by conditions. However, the case for additional hikes thereafter is nowhere near being made.”

It wasn’t just Yellen. Bullish sentiment got another boost when China reported upbeat data on exports and imports for June, in what was seen as a sign that global trade is finding some real traction again, helping push Asian shares up more than 1 percent. As shown below, every single indicator not only rebounded from May, but also beat expectations, while the Chinese trade balance rose to $294.3bn in June, above the $275.1bn expected.

- Imports (CNY)(Jun) Y/Y 23:1% vs. Exp. 22.3% (Prey. 22.1%)

- Exports (CNY)(Jun) Y/Y 17.3% vs. Exp. 14.6% (Prey. 15.5%) Chinese Trade Balance (USD)(Jun) 42.8B vs. Exp. 42.6B (Prey. 40.79B)

- Imports (USD)(Jun) Y/Y 17.2% vs. Exp. 14.5% (Prey. 14.8%)

- Exports (USD)(Jun) Y/Y 11.3% vs. Exp. 8.9% (Prey. 8.7%)

A quick macro recap of the overnight trading sessions via Bloomberg:

- ASIA: USD/JPY steady after touching a high of 113.53, with Japan’s govt bond yields down after strong 20-year bond auction results. Asia’s emerging-market currencies rose, led by the won, as Yellen stuck to gradual approach to tightening. CAD strengthened after Bank of Canada’s first interest-rate increase in almost seven years contributing to dollar weakness.

- EUROPE:Â EUR/USD initially higher on expectations ECB could send hawkish signals at its meeting next week, with bund futures volumes picking up, as benchmark 10y bund falls below 0.50% — a breach above that level was earlier widely seen as sell-off catalyst. However the Euro has dropped to session lows following the European open.

It has been a mostly green European session across asset classes, with the Stoxx Europe 600 Index climbed 0.5% adding to Wednesday’s 1.5 percent gain. Telecoms and retailers led gains. Bloomberg writes with EUR/GBP pushing to weekly low with focus on hawkish commentary from BOE’s McCafferty, EUR/USD hits session lows in tandem at 1.14. AUD outperforms with most citing overnight USD weakness as main driver, AUD/USD within range of YTD high. Gilts initially open lower in response to McCafferty before quickly reversing, led by the long end as the market impact of index extensions from coupon-paying gilts going ex-dividend provides support; bunds also lifted by old 10Y benchmark yield moving back below 50bps. Equity markets rally from the open led by miners; ArcelorMittal (+2.7%) after upgrade from Deutsche Bank, mining index above 50 and 200 DMAs. Crude futures edge lower after supply warning from IEA.Asia’s gains also lifted Indian stocks to an all-time high. South Korea and Australia’s main indexes both climbed 1.1 percent too, the former helped as its central bank kept interest rates at a record low. Japan’s Nikkei was restrained by a firmer yen and ended flat.