In a quiet night for markets, in which the top highlight was the Oscar’s historic peddling of best picture “fake news” and where “millions” of Academy members seemingly voted illegally, European stocks were little changed after a selloff that pushed them to a two-week low, while the MSCI Asia index fells as Japan’s Topix dropped for third day. S&P futures were unchanged after hitting a a fresh all time high on Friday. Oil futures gained, with the dollar little changed against a basket of major currencies. Priceline, Albemarle and AES are among companies reporting earnings. Dallas Fed manufacturing activity, durable goods sales data due.

European politics once again drove sentiment, this time higher after French electoral polls boosted the country’s bonds and reports of a potential Scottish independence referendum sank the British pound. The dollar was little changed before a key speech from U.S. President Donald Trump.

French bonds gained for a fourth day, with the 10-year OAT yields hitting a one-month low on Monday, pushing other euro zone sovereign yields lower, while a more cautious mood hung over world stock markets and the dollar, both of which struggled for clear direction.

The fall in French bond yields came as polls (everyone knows how accurate those can be) showed centrist Emmanuel Macron would easily beat far-right candidate Marine Le Pen in May’s presidential election runoff, relieving some fears that have built up in recent weeks among investors. “Macron gained further support in the polls,” said DZ Bank rates strategist Rene Albrecht. “Another important point is that it looks like Hamon and Melenchon won’t merge, so there is less of a chance that we will have a left-wing candidate that could outpace Macron or Fillon.”

Over the weekend, French press reported that Socialist lawmaker Christophe Caresche has announced that he will now back Macron, calling him the “only solution to counter effectively Marine Le Pen in the second round of the presidential electionâ€. That follows the news of Francois Bayrou publicly announcing his backing of Macron last week and the latest polls from the weekend suggest a boost to Macron following that. An Odoxa Dentsu poll published yesterday showed Macron as gaining 25% in the first round compared to 19% for Fillon and 27% for Le Pen. The pollster highlighted that this is the first time Macron has taken a 6% lead over Fillon in the first round. In a second round runoff the poll showed Macron as defeating Le Pen by 61% to 39%. The other weekend poll is the Kantar Sofres poll for Le Figaro. It showed a similar trend with Le Pen at 27% in the first round ahead of Macron with 25% and Fillon with 20%. A second round between Le Pen and Macron has the latter coming out on top at 58% to 42%.

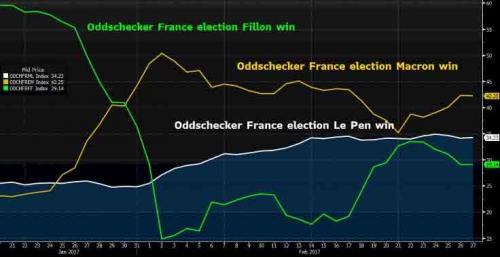

Following the latest polls, Oddschecker saw Macron gaining, with his victory odds rising above 42%, while Le Pen remained flat at just over a third.

As a result, France’s 10-year bond yield fell 2.5 basis points to a one-month low of 0.90%, outperforming euro zone peers. Safe-haven German bond yields DE10YT=TWEB edged higher, narrowing the gap between French peers to around 70 basis points, its tightest level in just over a week.

Furthermore, as discussed last night, sterling weakened against all its major peers after The Times reported Prime Minister Theresa May’s team is preparing for Scotland to potentially call for an independence referendum in March. European stocks fell, tracking a negative day across Asian equities.

It will be another week in which Trump can make or break the recent market euphoria. With elections taking place this year in France, the Netherlands and Germany against a backdrop of rising populism, and uncertainties around Trump’s policies, investors have been hanging on every word from central bank officials and politicians. The next focus is set to be the U.S. president’s speech to Congress on Tuesday, which will be parsed for details on spending and tax plans.

“We are concerned that the markets could be heading for a harsh reality check if the Trump administration fails to meet high expectations as reflected in strong equity gains, including risky assets,†Piotr Matys, currency strategist at Rabobank in London, wrote in a note to clients. “It seems to us that the markets are too optimistic, looking from the glass half full perspective and not pricing enough of the negatives.â€

In Europe, the French-led fall in bond yields and tightening of spreads over Germany were the most notable moves at the start of a week in which U.S. President Donald Trump’s State of the Union address on Tuesday will loom large. Trump is expected to unveil some elements of his plans to cut taxes in his joint address to Congress.

It was also a mixed bag in stocks. Benchmark European markets were flat, Asian bourses fell and U.S. futures pointed to a slightly higher open on Wall Street. “This morning’s moves follow what was a fairly cautious end to the week on Friday for markets,” said Jim Reid, markets strategist at Deutsche Bank (see full note below). MSCI’s benchmark world stock index slipped 0.1 percent to 444.53 points on course for its first consecutive daily fall for three weeks. On Thursday, it hit a record high of 447.67 points.

The index of the leading 300 European stocks was flat on the day at 1,457 points. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.3 percent, near the day’s lows and following Friday’s 0.7 percent fall. The Euro zone’s STOXX 600 index was down -0.3% at last check, at 369. Japan’s Nikkei closed 0.9 percent lower, hitting a 2-1/2 week low on concerns that a stronger yen would crimp corporate earnings.

Though U.S. stocks clawed their way to a higher close on Friday, major indices spent much of that day’s session in negative territory, suggesting increased caution. Yet it was the Dow’s 11th consecutive record high on Friday, which is the longest such run since 1987.