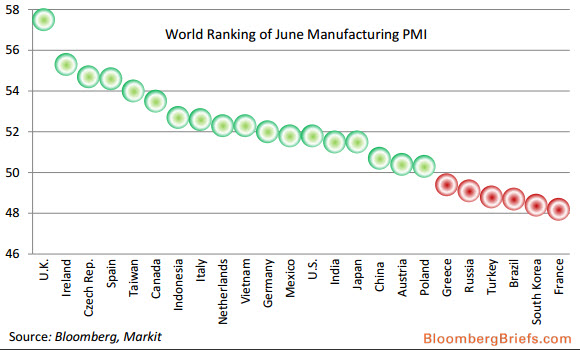

World rankings of June manufacturing PMIs point to GDP accelerating in the U.K. and the risk of the French economy contracting last quarter, according to Bloomberg Briefs’ Niraj Shah. The U.K. economy grew by 0.8% in the first three months of the year while French output failed to grow. The French and U.K. economies account for 3.59 percent and 3.4 percent of global output, respectively. Whether one should entrust any faith in forecasting future growth to these soft-survey data is questionable at best but the investing world appears happy to find more confirmation-bias confirming indicators.

Â

As another gentle reminder of how much faith to scribe to PMIs producing valuable output…

Destroying the ‘myth’ of the exuberant PMI data…

Via BofAML,

While a bit more than half of the recent data have been weaker than expected, the manufacturing and nonmanufacturing purchasing manager’s indexes have been very strong, jumping 4.8 and 5.8 points, respectively, since June. By some accounts, these data are better indicators than the hard numbers that come out of the government. After all, they are released very early, they are raw unfiltered data (other than seasonal adjustment), they are never revised and they are simple to interpret. We disagree. In our view, they are useful as a rough and ready early read on the economy. However, once the corresponding official data are released, we put very little weight on these surveys.

Â

It is important to understand how crude these surveys are. Each month, a few hundred purchasing managers are asked if a variety of activity variables are up, down, or the same relative to the prior month. Their responses are then converted into diffusion indexes: the sum of the number managers reporting activity is “increasing†and half of those reporting “the same.†Note that there is some guesswork involved: the survey is taken before the month is over and some of the questions cover areas of the firm that are difficult for a purchasing manager to get a timely read on. For example, a purchasing manager may not have a very precise idea of what is happening to hiring in a large, diverse firm. Moreover, since they don’t gather specific numbers for each series, they may have to make a rough guess, particularly if the trend is slightly up or down.