Just as the reflation trade appeared to be finding its latest wind, after a modest rise in oil prices over the past 24 hours (now that Andurand has finished liquidating his book) and a halt to the commodity rout in China, Trump threw the markets for a loop again with his firing of James Comey, which has implications on everything from Trump’s tax policy (most likely delayed due to more infighting between, and within, the two parties) to US geopolitics (will Trump launch another attack, this time against N. Korea to deflect from this scandal?)

“There is no doubt that Trump is dominating proceedings this morning after the sacking of Comey. This is a political story rather than a market story, but yet again it creates uncertainty in the market, which leaves everything the president does with a cloud floating over it,” said James Hughes, chief markets analyst at GKFX in London, quoted by Reuters.

“The Comey news is being treated as a risk-off event, and the headlines were sparking the dollar’s move down,” said Bart Wakabayashi, branch manager for State Street Bank and Trust in Tokyo.

As a result it has been a chaotic, mostly “risk-off” overnight session, in which S&P futures, some Asian markets and European stocks (which yesterday hit the highest level since August 2015) declined on the latest spike in political uncertainty after Trump’s abrupt firing of Comey. The USD weakened vs G-10 peers; in Japan JGBs sold off across the curve after BOJ’s Kuroda acknowledged that QE purchases have become smaller. The USD/JPY fell in response to the latest belligerent North Korean rhetoric in which a North Korean ambassador told SkyNews his country will conduct a 6th nuclear test, the only question is when. In the other Korea, the Kospi opened higher, rising to new records after Moon Jae-in won the South Korean presidential vote, but then erased early gains as the won weakens.

In Europe, continued reaction to U.S. political fallout: Eurodollar and UST curves bull flatten; bunds also supported by dovish ECB paper on labor market slack. GBP/USD whipsaws after re-approaching 1.30 level, GBP crosses drive price action amid little news; crude futures hold gains after bullish API data overnight, energy stocks support. In China the PBOC resumed open market operations after three-day pause, at the same time weakening the yuan fixing to lowest since March 21, however disappointment over the latest China inflation data sent the Shanghai Composite to the lowest since October 17. Crude oil has been little changed; iron ore gains 1%. Australian government bonds rise for first time in five days after Tuesday’s federal budget is seen supporting AAA credit rating.

“All in all, this does not support the view that the U.S. Trumpflation trade faces an easy road ahead of it,†Michael Every, head of financial markets research at Rabobank Group in Hong Kong, wrote in a note. “It underlines that real surprises can pop up out of the box at any time right now.â€

As a reminder, all this taxes place with the VIX in single digits, as the market has effectively assumed central banks have eliminated all risks.

While we have a more extensive list of overnight headlines below, these are the 6 main headlines that traders are focusing overnight on the BBG Terminal:

Key Headlines:

- Trump fires FBI director James Comey, citing need to restore ’trust and confidence’

- Pentagon urges North Korea to ’refrain from provocative actions and rhetoric’

- ECB Analysis Paper: labor-market slack might be closer to 15%; this is likely to continue to contain wage dynamics

- France March Industrial Prod. y/y: +2.0% vs +0.6% est.; Italy +2.8% vs +2.5% est.

- BOJ’s Kuroda: annual JGB purchase rate is now approximately JPY60t

- China April CPI 1.2% vs 1.1% estimate; PPI 6.4% vs 6.7% estimate

- Kuroda: Watching effect of FX changes very carefully; weak yen boosts corporate profits

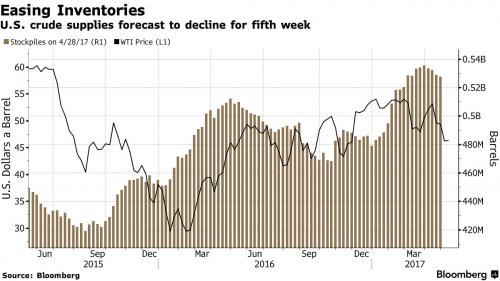

The dollar headed for the first drop in three days in the wake of Trump’s move, and after Federal Reserve Bank of Dallas President Robert Kaplan cast doubt on the pace of rate hikes in the world’s biggest economy. Treasuries advanced, while gold ended the longest run of losses since October. Roche Holding AG was the biggest drag on Europe’s Stoxx 600 Index after a cancer drug failed in a late-stage clinical trial. Oil climbed after the API reported a steep drop in US stockpiles, now extending for a fifth week. Today’s DOE report will be closely watched for confirmation.

The weakness across most markets comes in the wake of gains that sent global stocks to a record. Trump’s dismissal of Comey may threaten to undermine his administration as it attempts to move tax and spending plans through Congress, just as political risks ease in Europe and corporate earnings suggest the global economy is on the mend.

The European STOXX 600 index fell 0.2 percent, led down by construction and materials stocks, having hit its highest since August 2015 on Tuesday. Asian shares, excluding China, edged fractionally higher for a third consecutive day. MSCI’s main index of Asia-Pacific shares, excluding Japan rising 0.1 percent, having earlier matched a two-year high hit last week. The forward 12 month EPS for the index is at its highest level in more than three years. Tokyo shares hit a 17-month high, up 0.3 percent on the day as a relatively weak yen outweighed concerns triggered by Trump’s sacking of Comey.

In the red column, South Korean stocks led losers as investors took profits after liberal leader Moon Jae-in was elected president, while Chinese shares closed lower after factory gate prices ion the world’s second-biggest economy cooled more than expected in April.

The dollar fell 0.1 percent against a basket of major currencies after slipping on the view that political uncertainty could derail Trump’s tax reform plans, the prospect of which has helped lift riskier assets.

The yen, often sought in times of market uncertainty, was last 0.1 percent higher at 113.83 to the dollar. The euro was flat at $1.0870.