The overnight fireworks in Japan, which saw the Nikkei plunge by 860 intraday points and sent vol and volumes soaring (before recovering most losses), spooked traders in Asia and around the globe, and U.S. equity futures are red this morning, along with European shares and oil. As one early riser sellside desk notes, the Nikkei 225 provided the latest example of choppy markets and the 860 point intraday plunge “got us worried.Is this a warning sign for risk assets?” President Trump’s challenge of China for “unfair trading practices” (which he blamed on his predecessors) did not help the calm mood.

“The stock market has run out of a little momentum since the blow-out on the (Japanese) topix so it feels like it’s temporarily paused,†said Societe Generale strategist Kit Juckes. “We are waiting for some news from the Republicans on the tax plans, there is a bond market that has stalled and we’ve got rather soggy looking emerging markets… We probably need to get U.S. Treasury yields higher to get things going again.â€

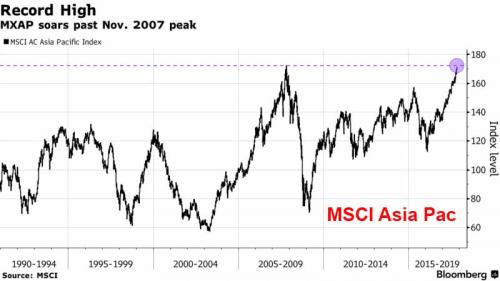

In the aftermath of the Japanese vol spike, the MSCI Asia Pacific Index turned briefly negative having earlier climbed to all-time record.

Â

Most of Europe’s main bourses also drifted in and out of the red after Japan’s disturbance spooked traders and after mixed earnings and as Brexit talks resumed with low expectations in Brussels. There were a series of ECB speeches and what should be buoyant new growth forecasts due later from the European Commission, though bond markets were mostly quiet following a rally this week in benchmark U.S. Treasuries and Bunds. In fact, German Bunds were sharply offered, with yields rising 9% on the day an approaching 0.36%: the move has dragged the rest of the European bonds lower, with OATs and Gilts also moving. According to some desks, this may be due to some rotation from the European equity markets, which are broadly trading into the red today and could be following in the footsteps of Nikkei.

Already shaken by events in Japan, basic-resources shares weighed on the Stoxx Europe 600 index following a decline in industrial-metals prices. An increase in growth expectations from the European Commission failed to lift stocks as disappointing results from companies including Siemens AG and Vestas Wind Systems A/S added to the malaise. Banks gained, led by Italian lenders after BPER Banca S.p.A. earnings beat estimates. Stocks in Asia earlier rose above their 2007 peak before an intraday reversal in Japanese shares on technically-driven trading pared gains in the region. Sterling edged lower as Brexit talks resumed, while oil halted a two-day drop.

Understandably, the yen was the dominant theme of the overnight session as investors rushed to buy the Japanese currency following the Nikkei plunge; the euro found support after the European Commission raised its growth outlook for the common area, while the pound reversed earlier gains as some hedge funds turned sellers;

Investor attention has been focused on Asia this week, where Trump has embarked on an 11-day tour. In Beijing Thursday, he said China is taking advantage of American workers and companies with unfair trade practices, but he blamed his predecessors in the White House rather than China for allowing the massive U.S. trade deficit to grow. A year after Trump was elected to president, investors are also reflecting on how financial markets have fared in the interim, and a rally that has outperformed all but 4 “new president” markets in US history.

As Bloomberg adds, elsewhere in the overnight session, the New Zealand dollar held onto Wednesday’s gains after the central bank flagged it may raise interest rates earlier than expected. The Kiwi was the day’s big mover, surging about 1 percent to a two-week high of before dipping to trade at $0.6956. The kiwi soared after the Reserve Bank of New Zealand (RBNZ) said the country’s fiscal stimulus and the currency’s recent fall would lead to faster inflation and likely an earlier rise in interest rates.

Treasury yields were range-bound as markets wait to see the U.S. tax proposal that will serve as the basis for further discussions. The kiwi was near two-week high after more hawkish RBNZ sends New Zealand’s 10-year yield eight basis points higher. Aussie dips briefly following surprise drop in housing finance activity and a subseqent short squeeze sent it to session highs; Australian sovereign bonds drift lower with 10-year yield up three basis points at 2.60%. JGB futures dip after mediocre 30-year auction tails 1.1bps.

The dollar index against a basket of six major currencies was 0.1 percent lower at 94.803 meanwhile, as it drifted further from the three-month high of 95.150 set in late October. A U.S. Senate tax-cut bill, differing from one already in the House of Representatives, was expected to be unveiled on Thursday, complicating a Republican tax overhaul push and increasing scepticism on Wall Street about the effort. Some also focused on fallout from Democrat wins in regional U.S. elections this week as signal for next year’s mid-term Congressional elections for U.S. President Donald Trump.

“There’s very much a risk of disappointment. The U.S. dollar could go through a weakening phase on the back of uncertainty around that tax reform,†said Steven Dooley, currency strategist for Western Union Business Solutions in Melbourne. Meanwhile, stalled Brexit talks resume on Thursday in Brussels with no indication that a breakthrough is in reach.

In commodity markets, Brent and U.S. crude oil futures were modestly lower, having hit two-year highs earlier in the week following a 40% surge since July. U.S. data showing a rise in domestic crude production had weighed on sentiment overnight but the Middle East uncertainty in Saudi Arabia limited the losses. Gold added 0.2 percent to $1,283.45 an ounce after rising to a three-week high of $1,287.13 an ounce the previous day. Palladium hovered near a 16-year high of $1,019 while nickel fell by more than 2 percent in London to its weakest since October as hype over potential electric vehicle demand that has been driving it higher eased. The nickel market had been ignoring downside risks from policy developments in supply markets Indonesia and the Philippines, and instead focusing on potential future demand from electric vehicle batteries, said Morgan Stanley in a report.