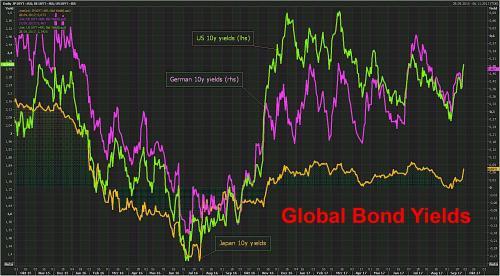

In a continuation of trading patterns observed over the previous two days, on Thursday the global bond rout deepened in the aftermath of the release of President Trump’s tax-cut plan, Janet Yellen’s recent hawkish comments and renewed optimism over the health of the U.S. economy. While global stocks were mostly mixed as investors tried to assess the implications of the much-anticipated tax proposal, there was less doubt in the bond market, where 10Y Treasurys tumbled as a result of heavy stop loss selling once the 200-DMA (2.3255%) was taken out, sending yields to three month highs around 2.35% as accelerating selling spread to all global rate products.

Bund futures slid from the open, with yield curves steepening as 10y yield briefly breached 0.5% for the first time since early August amid a surge in volume after the Treasury sell-off gained momentum in Asian hours.

“The market had given up on the Trump reflation trade and this is coming back with a bit more detail on tax plans,†said Commerzbank analyst Rainer Guntermann. “At the same time, this gives the Fed more ammunition to hike rates in the coming months.†Trump’s tax plan offered to lower corporate income tax rates, cut taxes for small businesses and reduce the top income tax rate for individuals.

Also helping to boost the dollar, the plan included lower one-time low tax rates for companies to repatriate profits accumulated overseas, which analysts say would lead to a temporary phase of sizable dollar buying. At the same time, others said it could be an uphill battle to get the changes approved. “It is hard to expect this proposal to pass the Congress smoothly.†Takafumi Yamawaki, chief fixed income strategist at J.P. Morgan Securities. “We have to pay attention to how the Republicans will view this,†he added “It is possible that the net fiscal spending will be smaller than what the stock markets expect.â€

Meanwhile, after rising early in the session to a six-week high, the US dollar pared gains as the euro rose with German regional inflation data pointing to continued potential overheating. That offered some support to Treasuries, after a slide in Asian hours as a global selloff in core bonds continued.

- German Hesse State CPI YY (Sep) 2.1% (Prev. 1.8%)

- German Hesse State CPI MM (Sep) 0.3% (Prev. 0.0%)

- German Brandenburg State CPI YY (Sep) 1.6% (Prev. 1.8%)

- German Brandenburg State CPI MM (Sep) 0.2% (Prev. 0.1%)

- German Saxony State CPI YY (Sep) 2.0% (Prev. 1.9%)

- German Saxony State CPI MM (Sep) 0.2% (Prev. 0.2%)

- German Bavaria State CPI YY (Sep) 1.8% (Prev. 1.8%)

- German Bavaria State CPI MM (Sep) 0.2% (Prev. 0.2%)

- German NRW State CPI MM (Sep) 0.1% (Prev. 0.1%)

- German NRW State CPI YY (Sep) 1.9% (Prev. 1.9%)

US futures were little changed, with European stocks were steady holding onto recent gains as rising banks balanced retailers, while Asian stocks were mixed, generally lower except Japan where the latest Yen weakness sent local stocks up 0.5%. Gold touched the lowest in a month.

In Europe, the Stoxx Europe 600 Index fell less than 0.01% as publication time. The U.K.’s FTSE 100 Index climbed less than 0.05 percent, while Germany’s DAX Index jumped 0.3 percent to the highest in more than 12 weeks. Banks rose to fresh seven week highs, though that was partly offset as miners struggled and as underwhelming results from one of Europe’s biggest fashion chains, H&M, weighed on retailers, while weakness in Chinese commodity markets continued overnight.Financials began where they left off yesterday and behave as one of the outperforming sectors in the Stoxx 600. And despite the positive open some EU markets lost early gains, as a fall among basic resources and the more defensive, consumer and health sectors weigh.

Emerging markets were the big losers from the surging dollar and as Treasury yield spike higher. MSCI’s emerging markets equity index was down 0.6% and was on course for its sixth straight daily decline.

Asian markets slipped as they headed to cap a third straight quarter of gains, the longest such winning streak since 2013. Japanese equities rose as the dollar strengthened, while Chinese shares fell ahead of a week-long holiday from Monday. The MSCI Asia Pacific Index dropped 0.2 percent, declining for a sixth day, the longest stretch of losses since Dec. 27. Energy stocks paced the retreat as crude oil fell for a third day, with China Petroleum & Chemical Corp. and PetroChina Co. the biggest drags on the industry gauge. ASX 200 (+0.1%) and Nikkei 225 (+0.47%) initially picked up on the recent US momentum however, Asia-Pac bourses pulled back from best levels amid a lack of catalysts to fuel the advances and as China clouded the tone with Hang Seng (-0.80%) and Shanghai Comp. (-0.2%) both subdued as investors took risk off the table ahead of the mainland’s week-long closure for National Day holidays.

“Japanese stocks rise today is boosted by the sentiment from the weaker yen,†Andy Ferdinand, head of research at PT Samuel Sekuritas Indonesia, says by phone from Jakarta. “Some traders might decide to tidy their books before the long holiday in China to avoid any unwanted surprises.â€

The greenback did check back against the yen easing off to 112.62 yen to the dollar having hit a 2-1/2-month high of 113.26 yen the previous day. The Canadian dollar also reversed losses after suffering its biggest drop in eight months on Wednesday, after Bank of Canada Governor Stephen Poloz dampened expectations for further interest rate hikes this year. Canada’s loonie was last at C$1.2468 to the U.S. dollar, having early slid to its lowest in a month.

Commodities were mixed, rebounding after earlier losses, with West Texas Intermediate crude gaining 1.1% to $52.69 a barrel, the highest in more than five months, while gold dropped 0.1% to $1,281.30 an ounce, the weakest in more than six weeks. Copper increased 0.4 percent to $6,462.00 per metric ton on the largest climb in more than two weeks.

In geopolitical news, South Korea is said to believe North Korea could conduct action between October 10th-18th which coincides with North Korea’s Communist Party Founding and China’s Communist Party Congress, according to sources.

Brexit rumors have reemerged, with the EU Parliament saying no sufficient progress on Brexit talks, with sources saying the EU are reportedly in discussions with bringing forward talks about the Brexit transition period. At the same time, PM May has stressed the opportunity that Brexit and free markets bring.