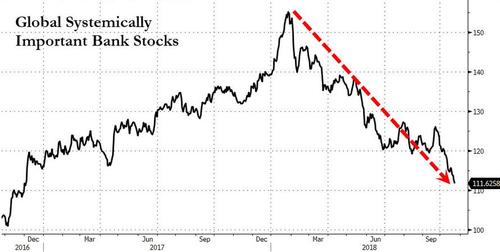

“Fortress balance sheets?”…”It’s different this time”… “Greatest economy ever.” If all of that is true, then why are the stocks of the most systemically important banks in the world collapsing?

And the banking collapse is leading global stocks lower – probably not coincidentally as global central bank balance sheets contract.

As The Economic Collapse blog’s Michael Snyder notes, if this reminds you of 2008, it should, because that is precisely what we witnessed back then. Banking stocks collapsed as fear gripped the marketplace, and ultimately many large global banks had to be bailed out either directly or indirectly by their national governments as they failed one after another. The health of the banking system is absolutely paramount, because the flow of money is our economic lifeblood. When the flow of money tightens up during a credit crunch, the consequences can be rapid and dramatic just like we witnessed in 2008.

So let’s keep a very close eye on banking stocks. Global systemically important bank stocks surged in the aftermath of Trump’s victory in 2016, but now they are absolutely plunging. They are now down a whopping 27 percent from the peak, and that puts them solidly in bear market territory.

U.S. banking stocks are not officially in bear market territory yet, but they are getting close.Â

At this point, they are now down 17 percent from the peak.

Monday early afternoon, the US KBW Bank index, which tracks large US banks and serves as a benchmark for the banking sector, is down 2.5% at the moment. It has dropped 17% from its post-Financial Crisis high on January 29.

17 percent while that may be a nerve-wracking decline for those who have not experienced bank-stock declines, it comes after a huge surge that followed the collapse during the Financial Crisis.

Of course European banking stocks are doing much worse. Right now they are down 27 percent from the peak and 23 percent from a year ago.Â