The broader U.S. market has finally recovered from its late January meltdown. Indeed, most sectors have gone on to reach all-time highs.

On the flip side, a number of influential segments and sub-segments are still laboring. For instance, the Financial Select Sector SPDR (XLF) remains roughly 5% below its January peak.

Theoretically, financial stocks should benefit from a rising interest rate environment. A healthy economy typically implies that borrowers have the capacity to repay. Moreover, with a strong economic backdrop, banks often have less balance sheet exposure to bad debts.

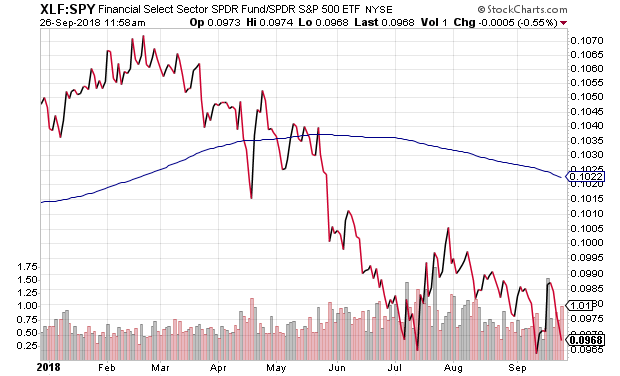

Unfortunately for investors in financial stocks, theory and reality have been diverging. The weakness in financials is readily apparent in the Financial Select Sector SPDR (XLF): SPDR S&P 500 (SPY) price ratio.

What accounts for financial stock underperformance? Investors may fear the possibility of a credit calamity.

Consider previous credit cycle busts. There was the Savings & Loan Crisis in 1990, the Asia Currency Crisis in 1998, the subprime catastrophe in 2008 as well as the euro-zone sovereign debt collapse in 2011.

Each required central bank bailouts with varying degrees of “success.†Each had been accompanied by bearish price depreciation ranging from 19% to 50%.

There may not be a definitive sign of a financial crack-up on the horizon. Nevertheless, the inability of the iShares Global Financial ETF (IXG) to restore early year glory suggests that investor trepidation may be building.

Keep in mind, the world has added something in the realm of $45 trillion in new debt since 2008’s financial upheaval. Most of that new debt will need to be rolled over and effectively refinanced at higher interest rates. Financial firms and pension funds will be increasingly exposed to borrowers on the brink.

U.S. market investors (ex financials) may be saying that domestic debt and deficits do not matter. At least today. At least right now. Still, the extraordinary disparity between foreign stock and U.S. stock valuations likely reflects anxiety about emerging market borrowing as well as euro-zone financial exposure to risky debts.