The third law of physics is: For every action, there is an equal and opposite reaction. That’s why I study cycles.

There are cycles in everything we see and do — from the weather and economy, to our careers and personal lives.

But with so many cycles, the key is to identify which ones are important to whatever you are measuring or trying to profit from.

That’s why, when the bubble from late 2002 to late 2007 was not nearly as strong as my earnings and demographic indicators suggested, I knew there had to be another important cycle showing itself.

That led to my discovery of the Geopolitical Cycle in early 2006. It is the second in my hierarchy of cycles, as it is not as fundamental to the economy as the Spending Wave. Predictable demographic cycles that impact housing and inflation are just more important…

But the Geopolitical Cycle still has a major impact on investor psychology. When a war, oil embargo, or major terrorist event comes along and wrecks a positive economic cycle, investors sound the alert!

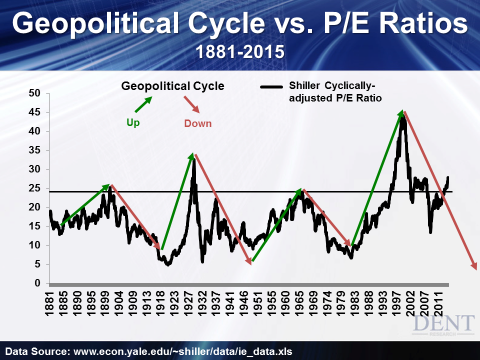

This can severely impact price-to-earnings ratios (P/E) on the same earnings trends for stocks. The P/E ratio can vary from five to 44 times — though more typically eight to 25. Still, that’s a huge deal!

The Geopolitical Cycle shows that our global environment is favorable for 17 to 18 years, followed by an adverse period that lasts the same amount of time. This chart shows how that relates to P/E ratios on stocks:

Â

Â

That’s a stunning correlation. When the geopolitical environment is favorable, P/E ratios rise. When it’s not, they fall.

Think about the adverse cycle we are presently in: 2001 to 2019. How does that compare to the favorable cycle from 1983 to 2000?

Hmm, let’s see. From 1983 to 2000, almost nothing went wrong in the world. Sure, we had a little 100-hour-long war in Iraq… but we didn’t meddle with their regime, beyond kicking Saddam Hussein out of our ally, Kuwait.