Image Source:

Image Source:

Asset prices are mixed this morning as market players weigh the benefits of lighter interest rates and better than projected economic data against rising geopolitical tensions and disappointing guidance from FedEx and General Mills. On the geopolitical front, events are worsening in the Middle East with the U.S. Navy shooting down missile and drone strikes from Tehran-Backed Houthi rebels. Shifting to the east, reports are surfacing that Beijing’s Xi Jinping told President Biden that Taiwan will reunify with his nation while also noting that his strong relationship with Moscow is a strategic choice.

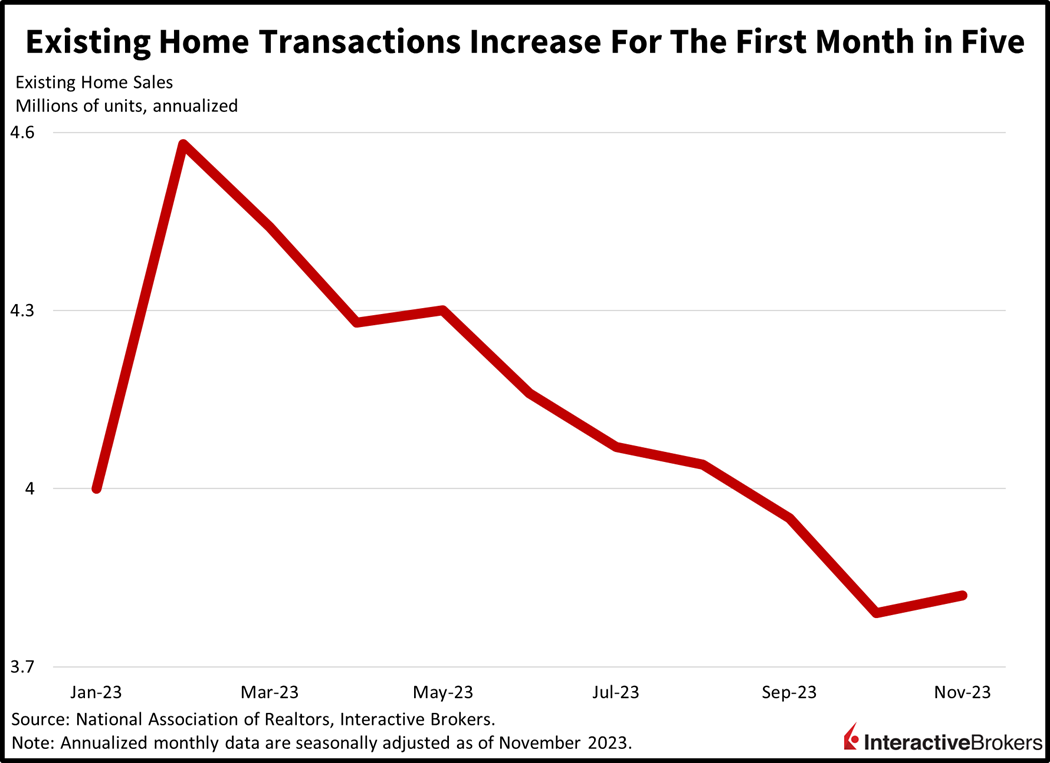

Real Estate Pointing to A Sharp Recovery

Similar to what we reported yesterday, softer mortgage rates, looser financial conditions and greater access to credit are leading to better than expected results for the real estate sector. Yesterday was construction activity, today is existing home sales, which rose to 3.82 million seasonally adjusted annualized units (SAAU) last month. Economists were expecting a number closer to 3.77 million SAAU, while October’s figure came in at 3.79 million. November marks the first return to growth in five months, with the most recent period of month-over-month growth occurring in May. The recovery was led by single family homes, which gained 0.9% m/m while condominiums and co-ops arrived unchanged. The South and Midwest regions contributed to gains, as sales rose 4.7% and 1.1% m/m. Meanwhile, the West and Northeast offset some of the progress, with transactions falling 7.2% and 2.1% m/m.

Consumers Cheer Stronger Asset Prices and Easier Financing

Consumers are also rejoicing at the sight of monetary accommodation, lower interest rates and loftier stocks prices, as this month’s Consumer Confidence figure shattered expectations. December’s Consumer Confidence Index came in at a whopping 110.7, rising sharply from last month’s 101 and sailing past the consensus estimate of 104. Both the Present Situation Index and the Expectations Index achieved solid gains, rising from 136.5 and 77.4 to 148.5 and 85.6. Households were generally pleased with business conditions, income opportunities and job prospects. Lower financing costs contributed to more plans to purchase expensive, durable items like automobiles, homes, and appliances. The top concern for consumers, however, was the rising costs for goods and services.

Corporates Point to Consumers Trading Down

On the corporate earnings front, however, things aren’t as rosy with FedEx and General Mills both reporting year-over-year declines in revenue and decreasing their guidance, which disappointed investors. Indeed, shares of the former are down 11% while the latter’s stock price is lower by 3%.Transportation specialist FedEx was hurt by less demand for goods, volatile macroeconomic conditions and customers shifting to lower cost providers. The company reported revenues of $22.2 billion, down y/y from $22.8 billion and missing projections of $22.4 billion. Earnings did grow y/y from $3.18 per share to $3.99 as the firm touts its impressive cost-cutting plans and margin expansion despite lower revenues, but Wall Street was looking for $4.18. The transportation company lowered its sales guidance for the second quarter in a row.Food products provider General Mills reported revenues of $5.14 billion, down y/y from $5.22 billion and missing the consensus estimate of $5.35 billion. Echoing FedEx, profitability increased despite lighter revenues. Weaker demand and declining affordability pressured the top line, as customers purchased less than usual and at times opted for cheaper, lower-quality products. Earnings per share rose from $1.10 per share to $1.25 y/y, beating expectations for $1.15. The company also trimmed its guidance.

Markets Not Ready for More Upside from Here

All major equity indices are near the flat line except for the small-cap Russell 2000, which is being supported by softer interest rates; it’s up 0.3%. Sectoral breadth is quite negative, which may be indicative of the end of the Santa Claus rally. 7 out of 11 sectors are lower, with consumer staples, utilities and materials leading the charge to the downside; they’re down 0.9%, 0.6% and 0.2%. On the flip side, communication services, energy, real estate and consumer discretionary are offsetting the negativity, with the segments higher by 1%, 0.7%, 0.5% and 0.1%. In fixed-income land, yields on the 2- and 10-year Treasury maturities are trading 5 and 2 basis points (bps) lower to 4.39% and 3.91%. The Dollar Index is up 10 bps to 102.24, however, as the U.S. currency gains against the pound sterling, euro and franc, despite rising odds for a March rate cut. The aforementioned European economies are likely to underperform due to delays and higher prices related to the delivery of goods, a result of the Middle Eastern conflict. The war premium is being reflected in energy markets as well, as the region produces about a third of the globe’s oil supply. WTI crude oil is up 0.9%, or $0.63, to $74.76 on the news, its highest level in almost three weeks. Reduced Fed tightening expectations are weighing on the greenback versus non-European currencies however, with the yen, yuan and Aussie and Canadian dollars gaining relatively.

Will Geopolitics Extend the Journey Across the Bridge?

Amidst a Santa Claus rally in stocks, an important consideration is whether hotter economic data and challenging geopolitics threaten the Fed’s accommodation next quarter. Peace is cheap and efficient. On the other hand, war is expensive and inefficient. What we’re seeing today are supply chain disruptions, higher commodity costs and a significant loosening in financial conditions. Taken together, these developments point to noteworthy inflationary risks that are not priced in by markets today. What market players need at this juncture, is a quick resolution to this conflict, or else the Consumer Price Index will return to a 4 handle in short order, deterring the Fed of monetary policy easing.More By This Author:

Geopolitical Conditions Intensify Amidst Firmer Econ Data