- GBP/USD has been rising amid an upbeat market mood and falling US yields.

- A refocus on US infrastructure plans may boost the dollar.

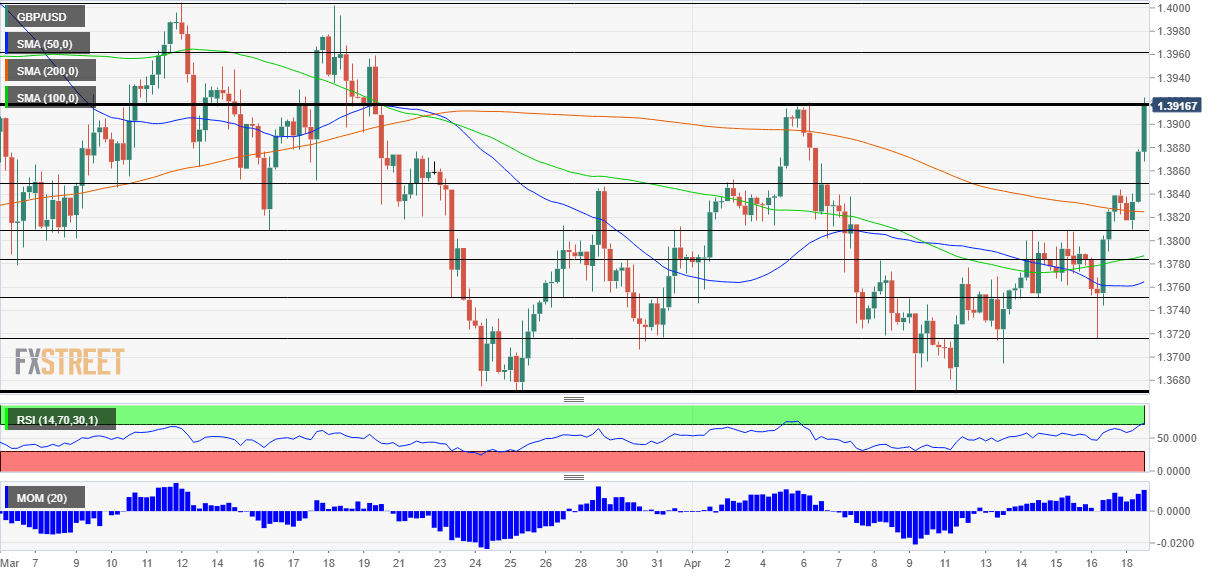

- Monday’s four-hour chart is showing cable is nearing overbought territory.

Worries about vaccine hesitancy? Not today, and not for sterling, that has shown no hesitation – GBP/USD is topping with 1.39, up some 200 pips from Friday’s trough. The main factor boosting cable comes from dollar weakness, which is suffering a double-whammy of falling US Treasury yields and a risk-on mood in markets. However, this trend may reverse.

The world is cheering America’s emergence from the coronavirus crisis, with robust US consumption seen as a catalyst for global growth. The demand for US bonds has also renewed, partly a correction and partly a reaction to upbeat demand in recent auctions.

Change may come from developments on President Joe Biden’s infrastructure spending plans. Several members of Congress are set to meet the Commander in Chief at the White House to discuss the details and move things forward. In the past, Biden opened the door to Republicans but still pushed through with substantial spending. Will that happen again?

If his $2.25 trillion expenditure drive gets a boost, it could cause a sell-off in bonds, thus pushing yields up and carrying the greenback higher for a ride. Moreover, the president wants to enact corporate tax hikes, something that Wall Street dislikes. If the current market rally comes to a halt, the safe-haven dollar may see fresh demand.

While the UK continues benefiting from its rapid vaccination campaign, the US is catching up quickly. America has reached 40% of its population with at least one dose.

All in all, cable’s current run is significant but may end abruptly.

GBP/USD Technical Analysis

Pound/dollar is benefiting from upside momentum on the four-hour chart and has surpassed the 200 Simple Moving Average on its way up. However, the Relative Strength Index (RSI) is tackling the 70 level – thus entering overbought conditions.

The crucial battle line is 1.3920, which was a peak in early April. It is followed by 1.3940 and by the psychological barrier of 1.40.

Support awaits at 1.3850, which held the pair back before its recent rally, and then by 1.3810 and 1.3780.

The pause that refreshes: Are currency markets hesitant to run with US data?