- GBP/USD has kicked off the new year with extended gains as the Brexit deal is being implemented.

- Optimism about vaccines could be outweighed by the fast spread of coronavirus.

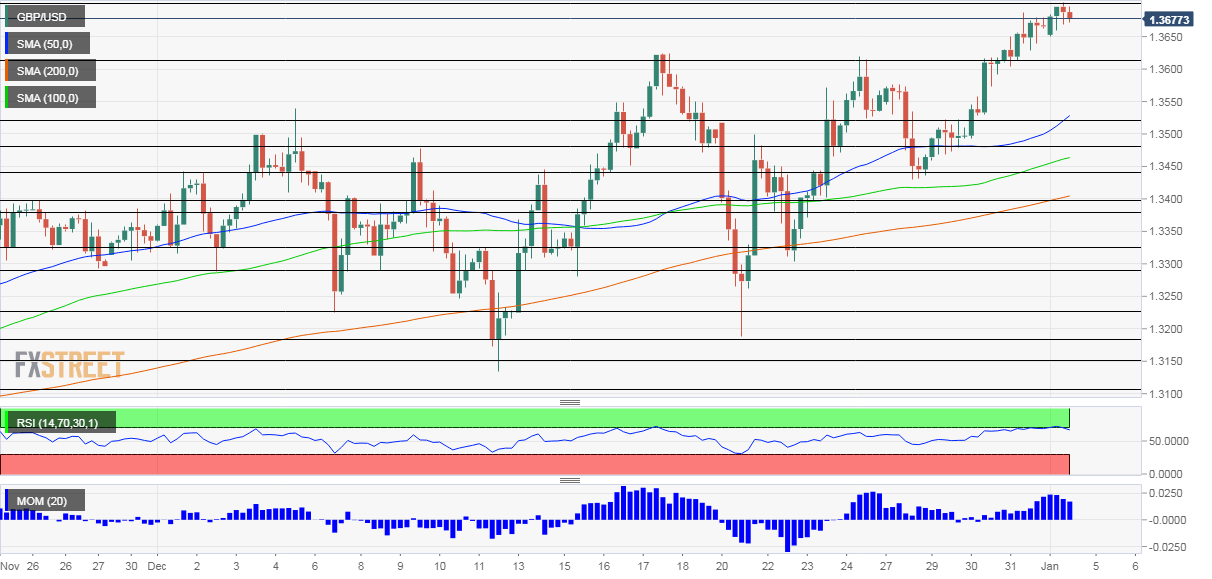

- Monday’s four-hour chart is pointing to near-oversold conditions.

Hopes that 2021 will be better than 2020 may face an early reality check on the first working day of the year – sending sterling falling from the high skies. GBP/US has flirted with 1.37 as investors continue pushing the pound higher after the EU and the UK reached a Brexit deal on Christmas Eve. That may change.

Markets are happy to see Britain leave with a deal – that was also broadly approved by parliament – and prevents a harsh no-agreement exit. However, it is essential to note that the accord focuses on goods and skirts dealing with services – on which the UK is reliant.

Formally, Britain left the transition period on January 1, yet the long New Year’s weekend pushed back most of the consequences to Monday, the first working day of the year. Traffic jams around Dover and issues for British businesses may begin appearing and weighing on the pound. Scottish demands to leave the UK and rejoin the EU may further weigh on sentiment.

The coronavirus front presents a similar picture – the worst has been avoided, but the reality remains grim. Regulators approved the University of Oxford/AstraZeneca vaccine late in 2020, adding to the green light for the Pfizer/BioNTech immunization.

The homegrown jab – which is available in large quantities and needs only normal cooling – will reach Brits’ arms on Monday, yet its efficacy rate is only around 70% in comparison to 95% in the Pfizer/BioNTech and Moderna jabs. Moreover, the pace of vaccinations is slower than expected.

In the meantime, COVID-19 is raging in the UK due to the new contagious strain. Prime Minister Boris Johnson has been urged to announce a new nationwide lockdown, putting the whole country on the highest Tier 4 restrictions – or even new Tier 5 ones. Any announcement of new restrictions could weigh on sterling.

A similar slow pace of inoculations is seen in the US, which has suffered over 350,000 covid deaths. US virus statistics show some moderation, but they may be skewed due to the holiday season.

The focus in America is on Georgia, where Tuesday’s two runoff races to the Senate will determine control of the upper chamber – and new stimulus. Democrats need to win both seats to have the thinnest of majorities.

All in all, optimism about UK prospects may suffer a blow and the safe-haven dollar could see some demand amid political uncertainty.

GBP/USD Technical Analysis

The Relative Strength Index on the four-hour chart is just below 70 – near overbought conditions. Upside momentum remains significant, yet off the highs. The pair remains above the 50, 100, and 200 Simple Moving Averages, a bullish sign.

All in all, cable has limited room to rise.

Resistance is at the daily high of 1.3703, which is also the highest since 2018. Resistance awaits at 1.3730 and 1.3810, levels last seen nearly three years ago.

Support awaits at 1.3620, a high point around Christmas, followed by 1.3525 that capped the pair last week. Further down, 1.3480 and 1.34 await GBP/USD.