- The dollar is gaining ground as President Biden may eventually pass a large stimulus bill and yields are rising.

- America’s vaccination campaign is catching up with Britain’s, also supporting the greenback and weighing on GBP/USD.

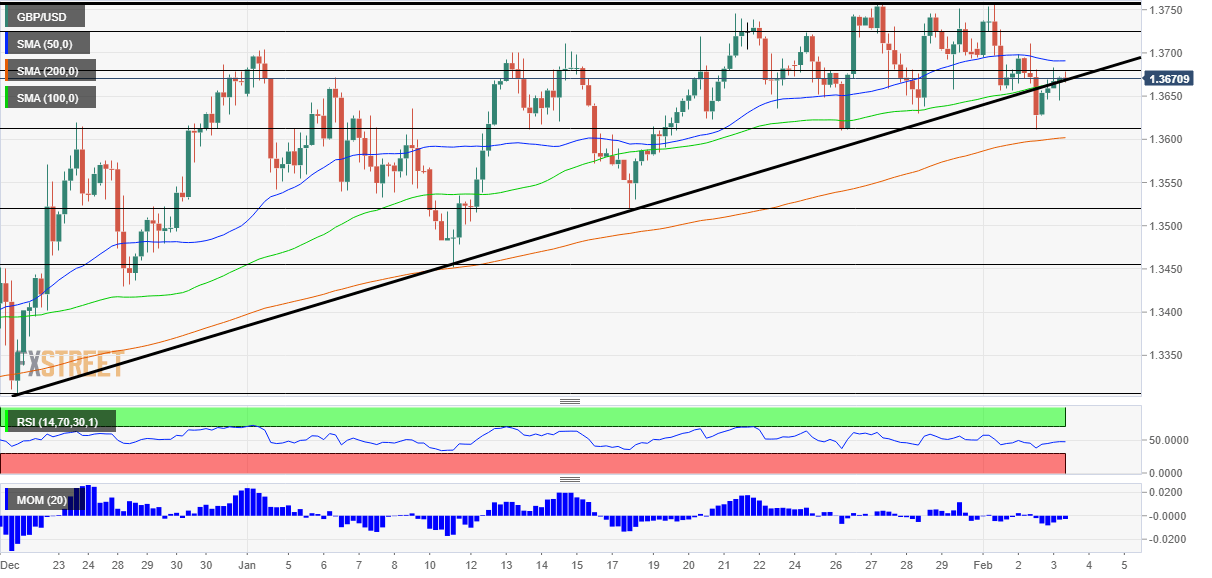

- Wednesday’s four-hour chart is pointing to further losses for cable.

Any positive thing has to come in the right dosage – America’s stimulus package may be larger than expected and that is weighing on GBP/USD after boosting it earlier. The US dollar has been gaining ground as investors sell Treasuries in response to higher prospects of a generous relief package.

Senate Democrats have advanced a partisan reconciliation bill, taking the first step in potentially approving President Joe Biden’s proposed $1.9 trillion stimulus package. The move on Tuesday surprised markets after the Commander-in-Chief met a group of ten Republican lawmakers who offered a counter proposal of only $600 billion. The unilateral move by Biden’s party raises the chances for “going big” – support worth closer to the upper edge.

The prospects of more robust US growth – as well as elevated debt issuance – weigh on bonds and the resulting higher yields make the greenback more attractive. Moreover, America’s economy is getting a shot in the arm from a ramped-up vaccination campaign. Pharmacies are set to begin administering vaccines next week while both Pfizer and Moderna also upgraded its forecast for delivering doses of the vaccine.

The UK is mostly reliant on AstraZeneca’s immunization solution, and there is good news on the front as well. Britain’s bet on a three-month gap between the first and second inoculations has proved more efficient than a tighter timetable. That would allow reaching more people quickly, boosting the economy. Will this upbeat news boost sterling? That remains an open question.

On both sides of the pond, coronavirus cases and hospitalizations are declining, keeping a tight race. Apart from the vaccine and political developments, pound/dollar is set to move in response to two top-tier US data points. ADP’s labor figures are projected to show a small increase in private-sector employment, while the ISM Services Purchasing Managers’ Index is forecast to edge lower. Both statistics serve as leading indicators toward Friday’s Nonfarm Payrolls.

See

- ADP Employment Change January Preview: A return to hiring?

- Purchasing Managers’ Index January Services Preview: No reason to pull back now

All in all, the battle is raging, but sterling lost the edge it had.

GBP/USD Technical Analysis

Bears have defied the ascending triangle pattern – a bullish one. Pound/dollar has slipped below the uptrend support line. While it is still fighting to recapture the line, the currency pair has slipped below the 100 Simple Moving Average on the four-hour chart, a bearish sign and momentum remain to the downside.

Support awaits at the weekly low of 1.3610, followed by 1.3520 and 1.3455, which were stepping stones on the way up in January.

Resistance is at 1.675, the recent high, followed by 1.3720, a previous 2021 peak, and then by 1.3752, the multi-year high.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits