- GBP/USD has failed to hold above 1.38 as the dollar gained fresh ground.

- US Retail Sales will likely dominate trading, overshadowing Britain’s reopening.

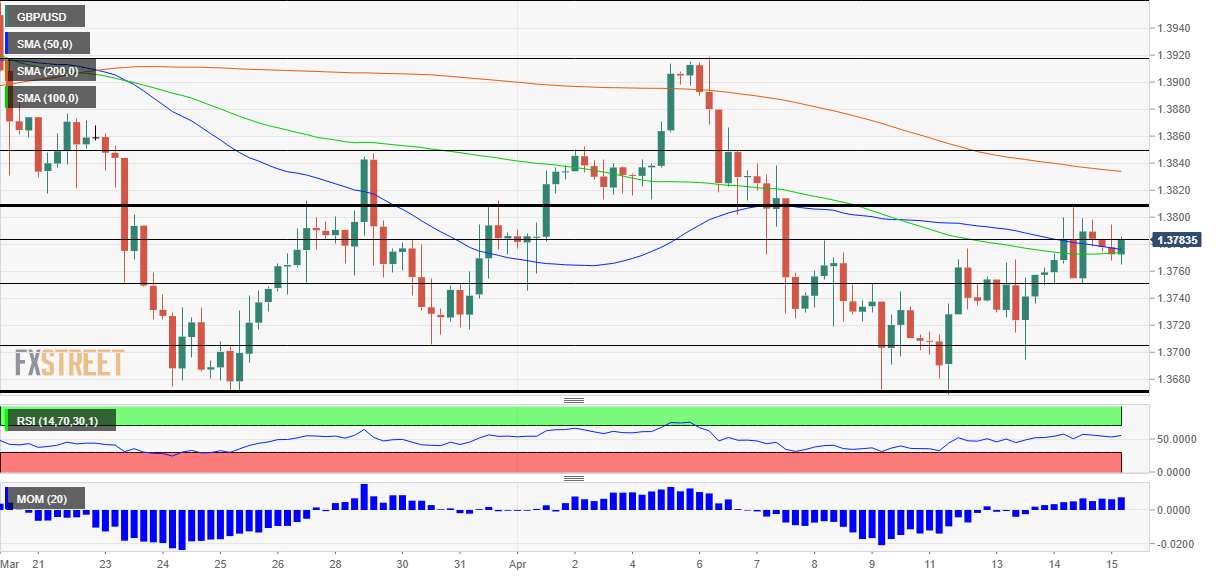

- Thursday’s four-hour chart is painting a mixed picture.

Shop until you drop – that is what the upcoming release of US Retail Sales is set to reveal about Americans’ buying in March. While expectations are already high at around a 5% bounce, uncertainty is high and a greater leap may be seen. Armed with another round of stimulus checks – $1,400 in March after $600 in January – a double-digit leap in expenditure cannot be ruled out. That may give the dollar another boost.

US March Retail Sales Preview: Can a strong rebound ramp up inflation expectations?

The greenback has already been turning back up following comments from the Federal Reserve’s leaders. Chair Jerome Powell mentioned tapering bond buys, saying it would come before raising rates. Vice-Chair Richard Clarida mentioned that a signal on reducing purchases of Treasuries would come in a meeting including new forecasts – making June’s FOMC meeting critical.

The Fed is buying $120 billion worth of bonds and mortgage-backed securities per month and any reduction in the flow of funds may cause jitters in markets – a “taper tantrum.” If fewer dollars flow into markets, the currency may rise in value. The mere talk of such a move – which may perhaps come early in 2022 – is already keeping the world’s reserve currency bid.

How is the pound positioned? Sterling received a boost earlier this week as Britain lifted a significant portion of its restrictions. The return to pubs, gyms and hairdressers has come on the backdrop of a sharp drop in COVID-19 infections. Concerns about Johnson & Johnson’s jabs has no effect on the UK, which does not use them.

Despite upbeat prospects for Britain, dollar strength may prove overwhelming.

GBP/USD Technical Analysis

Pound/dollar benefits from upside momentum on the four-hour chart and is trading marginally above the 50 and 100 Simple Moving Averages. However, cable is still below the 200 SMA. All in all, bulls have a small lead.

Critical resistance awaits at 1.3810, which is the weekly high and a level that had previously capped cable. It is followed by 1.3850 and 1.3920.

Support awaits at 1.3750, the bottom of the current range, followed by 1.37 and 1.3670 – the latter is a crucial level.