- GBP/USD has been attempting recovery amid a calmer market mood.

- A fresh rise in US yields, concerns about UK tax hikes may keep cable capped.

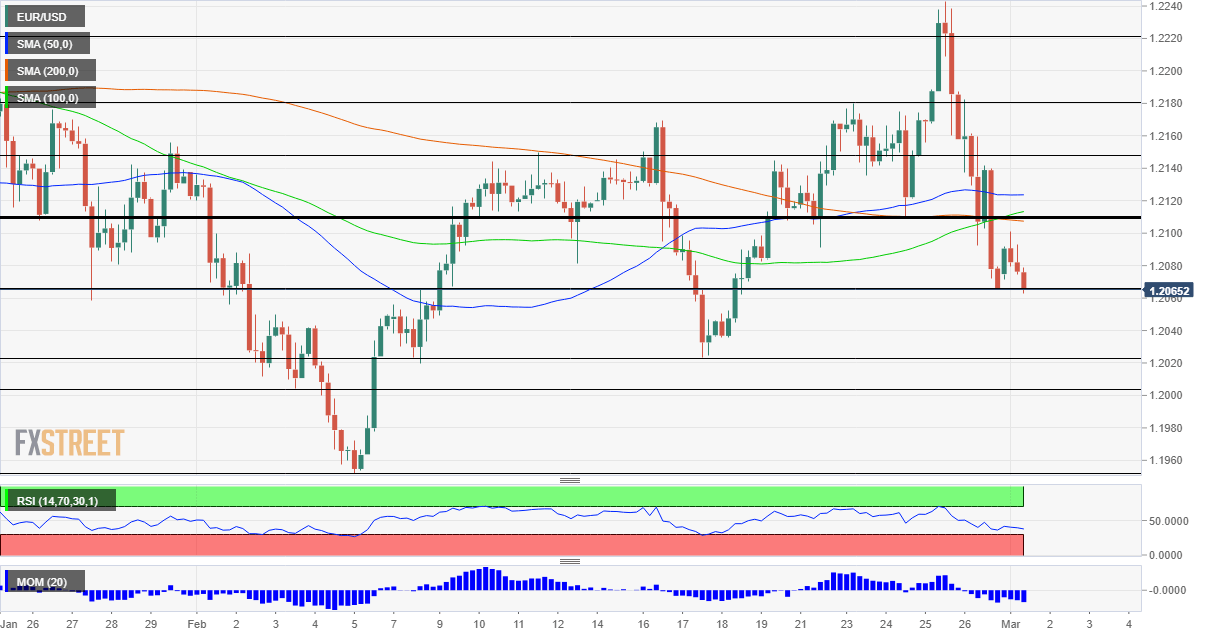

- Monday’s four-hour chart is painting a mixed picture.

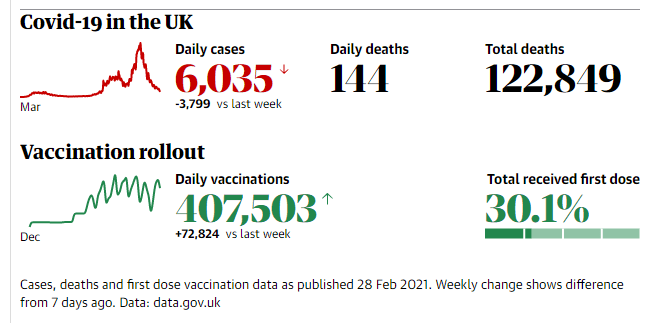

Three in every ten Brits has already received one vaccine dose – but that impressing inoculation rate is already priced into sterling, which needs new catalysts to rise. However, speculation about raising the corporate tax rate in the UK may do the opposite.

Source: The Guardian

Rishi Sunak, Britain’s Chancellor of the Exchequer, is set to present a new budget on Wednesday and pushing up rates that companies pay is high on the agenda, according to hints he made on weekend interviews. Will that make Britain a worse place for doing business? That is something for pound bears may grab on, at least in the short-term. On the other hand, the US is also considering reforming its contribution structure and the UK’s corporate tax is currently low.

A more significant factor that may keep cable capped comes from the US. The dollar stormed higher last week as investors repriced chances for the Federal Reserve to raise rates and/or cut back on its bond-buying scheme.

While Fed Chair Jerome Powell was speaking, markets were relatively calm, but then the levee broke on Thursday. Prospects of stronger growth and perhaps elevated inflation sent traders away from bonds, the resulting higher returns made the greenback more attractive.

The new week and month begin with some calm. However, there is room for US yields to rise due to several factors. First, the ISM Manufacturing Purchasing Managers’ Index will likely show robust expansion in the industrial sector, and also boost expectations for Friday’s Nonfarm Payrolls.

See US ISM Manufacturing PMI February Preview: Will business catch up with consumers?

Secondly, the Senate is discussing President Joe Biden’s $1.9 trillion covid relief bill. According to reports, Democrats have abandoned their plans to raise the minimum wage, a thorn on the side for several conservative members of the left-leaning party. That paves the way for a more generous package – only somewhat lower than the original plan – which in turn would raise inflation expectations.

Powell is back in the public eye on Thursday, and several of his colleagues will speak by then. Will they succeed in pushing yields lower? If they refrain from pledging additional purchases of US debt, the bond sell-off could extend and carry the greenback higher.

All in all, while the UK is doing well, there is no confirmation that the dollar storm is over. Not yet.

GBP/USD Technical Analysis

Pound/dollar is suffering from downside momentum on the four-hour chart and is trading below the 50 Simple Moving Average. On the other hand, the currency pair is holding above the 100 and 200 SMAs.

Support awaits at the daily low of 1.3925, followed by strong support at 1.3885, last week’s trough.Further down, 1.2860 and 1.13830 are eyed.

Critical resistance awaits a 1.40, which is a psychologically significant level and also the daily high. Moreover, it is closely backed up by the 50 SMA. The next levels to watch are 1.4025, 1.4050 and 1.4090.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits