- GBP/USD has bounced from the triple bottom as the UK reopens.

- Brexit issues, US inflation and concerns, and vaccine scares may curb bulls’ enthusiasm.

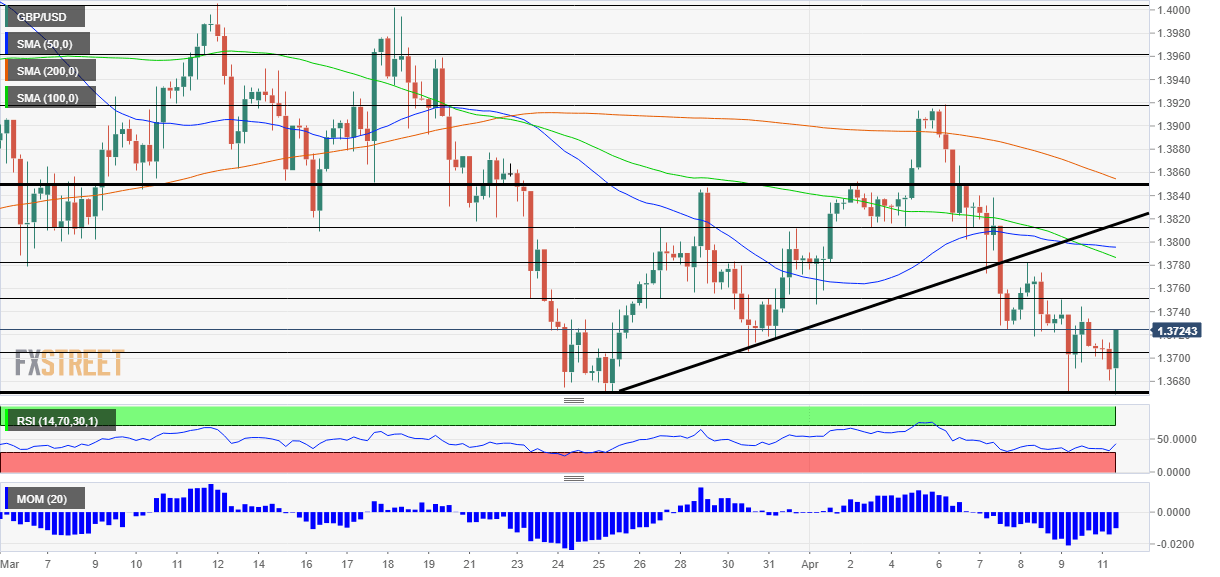

- Monday’s four-hour char is showing bears are in the lead.

A day of freezing temperatures may not be the best day to return to the high street – and perhaps not the best timing for a reopening rally for sterling. Nevertheless, GBP/USD is moving higher, bouncing off the stubborn 1.3670 level as Brits return to shops, gyms, and perhaps most importantly – pubs.

Can the recovery continue? There are still three dark clouds looming over cable, that may inhibit any upside.

1) Brexit issues: While the EU and the UK are reportedly nearing a settlement related to commerce in Northern Ireland, tensions remain elevated in the province. Colder weather may have prompted a pause in violence, but frustrations around the Brexit accord may reignite riots on the streets of Belfast. Moreover, British exporters continue suffering from non-tariff barriers.

2) US inflation lifts its head: Producer prices shot higher in March, beyond the “base-effects” related to the bounce from pandemic-depressed costs seen last year. Jerome Powell, Chair of the Federal Reserve, noted that the US economy is at an “inflection point” – on the verge of rapid growth. Will the Fed be forced to raise interest rates sooner rather than later? The greenback is gaining ground. So far, the pound has put up a fight against the greenback, but things may change.

More Dollar rally coming? Clarida’s clarity, powerful PPI, point to the Fed raising rates sooner

3) Virus: The US and the UK are both vaccinating their populations at a rapid clip, but worries remain prevalent. First, cases continue rising in the US, especially in Michigan. In addition, a study published in Israel has shown that the Pfizer/BioNTech jabs – in wide use on both sides of the pond – are less efficient against the South African variant. If these worries persist, it could boost the safe-haven dollar.

All in all, the reopening rally looks robust, but it could end abruptly due to one or more of these factors.

GBP/USD Technical Analysis

Pound/dollar continues suffering from downside momentum on the four-hour chart and trades below the 50, 100 and 200 Simple Moving Averages. On the other hand, it has bounced three times off the 1.3670 level, showing its resilience. All in all, bears are in the lead, but bulls have not thrown the towel.

Some support awaits at 1.3705, which was a swing low in late March. It is followed by the 1.3670 level mentioned earlier, and then by 1.36.

Some resistance awaits at 1.3750, which is was a cushion in March, followed by 1.3780, a swing high recorded last week. Further above, 1.3810 is eyed.

Bank to the Future: Interest rates return to market center stage