- GBP/USD has been trading around 1.36 as tensions grow toward US Nonfarm Payrolls.

- Optimism about vaccine approval and deployment may boost the pound.

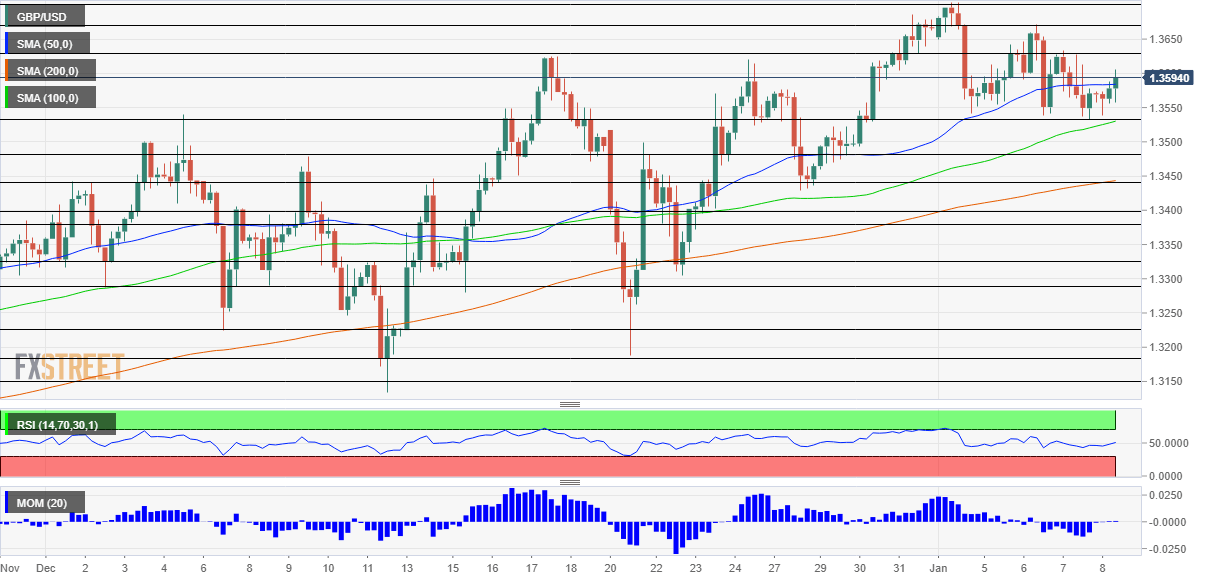

- Friday’s four-hour chart is showing bulls are gaining ground.

A week that has seen the historic storming of the Capitol has also experienced relatively limited movement in GBP/USD – but that may change on Friday. After cable retreated from the highs in response to the UK’s harsh lockdown, things may turn in favor of the currency pair.

Here are three reasons why:

1) British vaccine progress

While hospitals in London are raising the alarm over potentially being overwhelmed later this month, recent infection figures have shown some stability. The new lockdown or the previous one may begin working. Additional data due later in the day may shed more light on the disease’s development.

More importantly, Britain is ramping up its efforts to beat the virus. Regulators are set to approve Moderna’s vaccine, bringing the total number of immunization schemes deployed in the UK top three. Another shot in the arm comes from concerted efforts by the government to speed up the distribution of jabs across the county.

More Coronavirus: Statistics, herd immunity, vaccine calendar and impact on financial markets and currencies

2) Nonfarm Payrolls

The dollar’s rise came from higher yields – a result of expectations for higher debt following a new stimulus driven by the new administration. President-elect Joe Biden’s won an effective majority in the Senate after the Georgia runoff elections.

While the events were overshadowed by the violent incursion of Capitol Hill by supporters of President Donald Trump, the greenback reacted to higher returns on debt rather than anything else.

Five factors moving the US dollar in 2021 and not necessarily to the downside

What can bring yields down and make the dollar less attractive? Bond-buying by the Federal Reserve and that could happen if economic data deteriorates. The Nonfarm Payrolls report for December is set to show a notable slowdown in hiring – and perhaps a loss of jobs. Any disappointment could prompt action from the Fed, which already expressed its readiness to act.

See:

- Nonfarm Payrolls Preview: Long path to recover to be even longer

- US Nonfarm Payrolls December Preview: Labor economy woes escalate

3) Technicals are improving

Momentum on the four-hour chart has turned positive for GBP/USD – which has also been able to recapture the 50 Simple Moving Average it had lost on Thursday. While sterling is still not out of the woods, the picture is improving.

Some resistance awaits at 1.3620, the mid-December high, followed by 1.3676, the 2021 high. Further above, the next level to watch is 1.3705, the 2020 peak.

Support awaits at 1.3630, the daily low, followed by 1.3480, 1.3445, and 1.34.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits