Tomorrow is the interest rate decision and general monetary policy summary coming out of the Bank of England. This is actually quite interesting because the UK is just out of a favorable Brexit vote that has pushed the pound to extreme low levels, level we haven´t seen for decades in the gbp/usd.

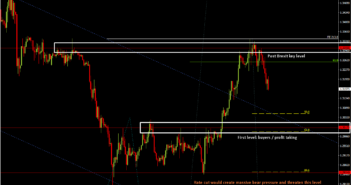

After the election of a new Prime Minister the pound rallied 490 pips from the lows of 1.2850 to a key post Brexit area. After the Pound dropped over 2000 pips versus the Dollar after the Brexit vote, it had a relief rally and tested several times the 1.3300 zone before breaking to the ultimate lows.

Now the Pound has rallied again to these levels against the Dollar giving us a great short opportunity before the interest rate decision tomorrow on which the markets are anticipating a rate cut to 0.25% from 0.50%. If the rate cut is real and we see more intervention and easing from the Bank of England the Pound is going to catch a very bearish sentiment and shorts from today´s setup are going to profit massively from it.

This drop will put more pressure to the 1.2850 and 1.2788 levels which are the ultimate bull bear frontier in this pair. If we see further easing from the BoE we can expect these levels to break and a further Pound depreciation to get us even close to parity against the USDollar.

[Orlando Gutierrez]

[www.snipethetrade.com]