Image Source:

Image Source:

The pound extended its losses against the greenback for the third straight day on Friday, as it declined around 0.47% after UK Flash PMIs and Retail Sales data disappointed investors. This, along with heightened geopolitical tensions due to Russia-Ukraine and Middle East conflicts, bolstered the American currency. As of the time of writing, the GBP/USD pair was seen trading at around the 1.2529 area after hitting a daily high of 1.2594.

GBP/USD Hovered Around the 1.2520 Level; Market Players to Await Next Week’s US-UK Docket

The market mood shifted positively in recent trading, capping the greenback’s advance. Although the GBP/USD pair has remained pressured, next week’s economic docket will be crucial in dictating the direction.In the UK, the economic docket will be scarce. First, Bank of England (BoE) Deputy Governor Clare Lombardelli will give a speech on Monday, followed by the release of the CBI Distributive Trades. Next would be Car Production, Nationwide Housing Prices, and the Financial Stability Report.Across the pond, the US schedule will feature housing data, the release of the Federal Reserve’s last meeting minutes, Durable Goods Orders, and the release of the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index,

GBP/USD Price Forecast: Technical Outlook

The GBP/USD cross has been trending down, extending its bearish bias. Sellers were eyeing intermediate support at the 1.2445 level, the May 9 swing low. If this is breached in the coming days, the pair could look to the year-to-date low of 1.2299, which was hit on April 22.Indicators like the Relative Strength Index (RSI) turned oversold beneath the 30 level. Nevertheless, it has not yet reached extreme levels, usually seen in solid trends. In the case of a downtrend, the 20 level would suggest the GBP/USD currency pair is oversold.Conversely, if bulls move in and reclaim the 1.2600 level, traders could look for a test of the Nov. 20 peak at the 1.2714 mark as the next resistance. If surpassed, the next stop would be the 200-day Simple Moving Average (SMA) at the 1.2818 level.

GBP/USD Daily Price Chart

(Click on image to enlarge)

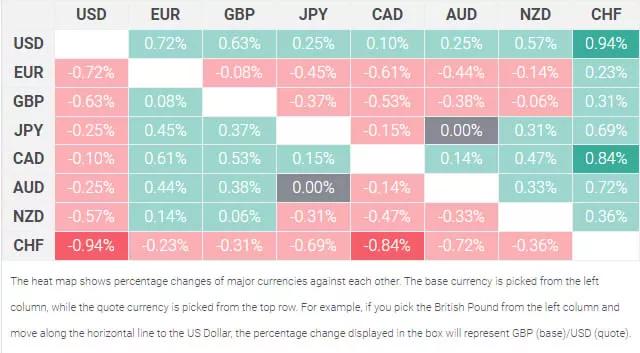

British Pound Price Change

The table below shows the percentage change of the British pound against other major currencies as of Friday, Nov. 22. The British pound was the strongest against the Swiss franc. More By This Author:Silver Price Forecast: XAG/USD Dips As U.S. Dollar Strength Pushes Price Below $31.00 Silver Price Forecast: XAG/USD Rallies Over 3%, Reclaims $31.00 GBP/USD Price Forecast: Steadies At Around 1.2600

More By This Author:Silver Price Forecast: XAG/USD Dips As U.S. Dollar Strength Pushes Price Below $31.00 Silver Price Forecast: XAG/USD Rallies Over 3%, Reclaims $31.00 GBP/USD Price Forecast: Steadies At Around 1.2600