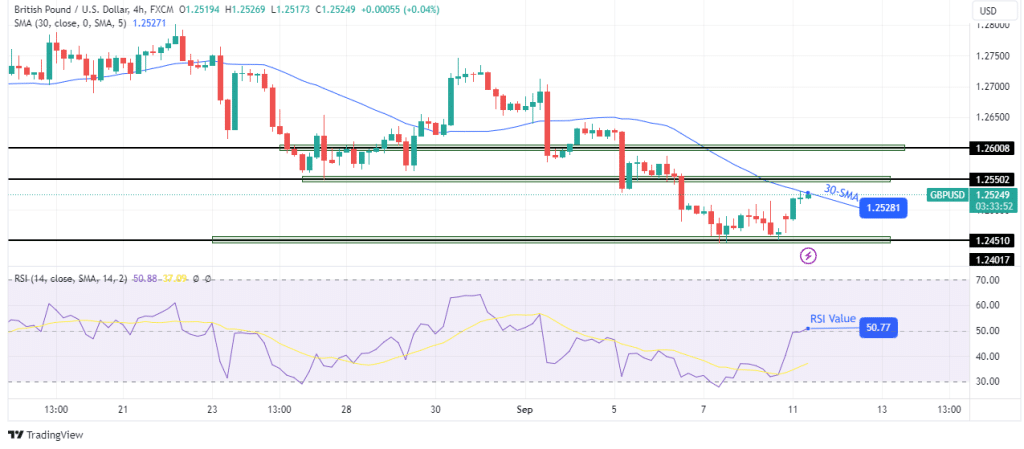

Today’s GBP/USD outlook is bullish. On Monday, the pound strengthened, capitalizing on a significant decline in the dollar against the Japanese yen.-Are you looking for automated trading? Check our detailed guide-Notably, Bank of Japan Governor Kazuo Ueda’s weekend statement suggested that the central bank might discontinue its negative interest rate policy when it gets closer to achieving its 2% inflation target. Consequently, the dollar faced the brunt of the rush into the yen, experiencing its most substantial drop against the Japanese currency in two months. Meanwhile, the pound depreciated nearly 1% against the dollar last week. A combination of robust economic data and waning investor confidence increased demand for the US currency.Elsewhere, the Bank of England will convene next week to discuss monetary policy. Currently, traders assign a 70% likelihood of a quarter-point increase in the Bank Rate to 5.50%. However, the prospects of additional rate hikes have been significantly reduced. This marks a stark reversal from just a week ago when money markets projected that UK rates could peak closer to 5.7% by March.One reason for the pound’s strength this year has been the perception that the Bank of England needs to take more action to curb inflation. Consequently, investors expected more interest rate hikes compared to other central banks. However, with market participants seeing the end of this cycle in sight, the pound may face challenges in gaining significant upward momentum in the coming weeks.GBP/USD key events todayInvestors do not anticipate significant developments from the UK or the US today, so the price will likely extend the yen move.GBP/USD technical outlook: Bulls challenge bias with RSI crossing 50.

GBP/USD Outlook: Pound Strengthens as Dollar Slides vs. Yen