- GBP/USD has been resisting yield-driven dollar strength ahead of Fed Chair Powell’s speech.

- The well-received UK budget and Britain’s vaccination campaign continue supporting sterling.

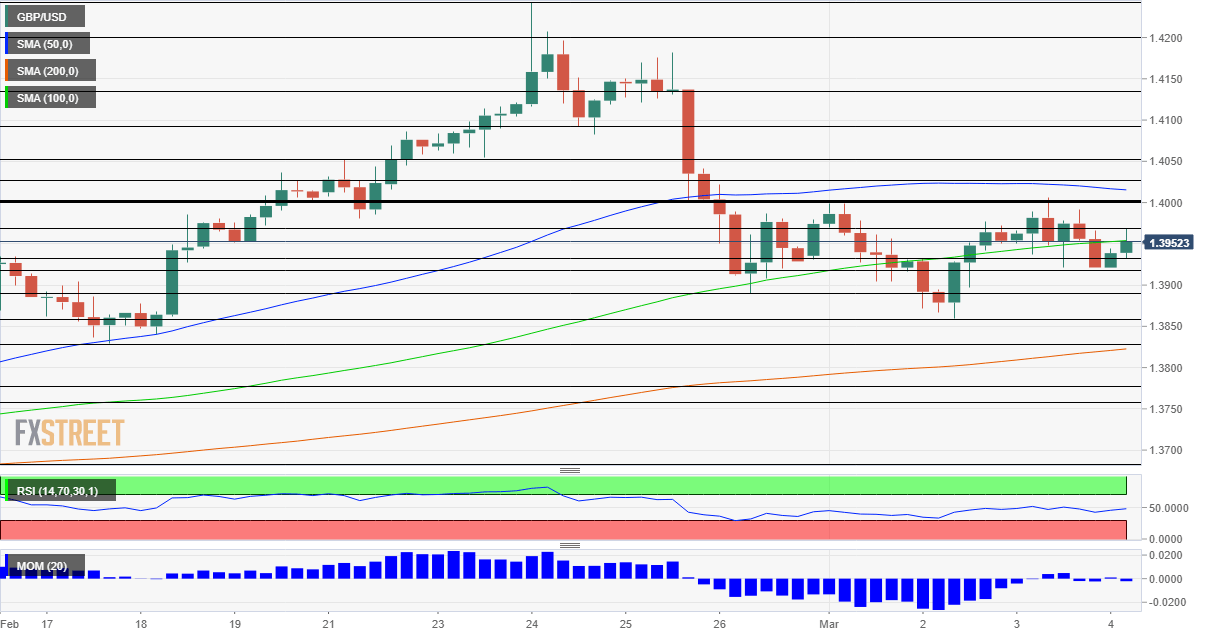

- Thursday’s four-hour chart is painting a mixed picture.

Sterling to sink? Not under Rishi Sunak – the UK Chancellor of the Exchequer has surprised markets by announcing a “super deduction” for firms that would encourage investment. While Britain’s new budget consists of a sharp corporate tax hike in 2023 – from 19% to 25% – upbeat economic forecasts, extending the furlough scheme and other goodies seem to set the economy on a positive footing.

The pound also continues benefiting from the UK’s rapid rollout of vaccines, which are hovering near one-third of the population – the world leader among large countries. And now, the next moves depend solely on what happens in America.

GBP/USD has been able to resist dollar strength, as yields on US Treasuries remain elevated – uncomfortably close to the 1.50% on ten-year bonds, the global benchmark. Investors abandoned US debt as President Joe Biden continued pushing his covid relief program by agreeing on a compromise with moderate Democrats. The $1,400 stimulus checks will go to fewer Americans. While this implies fewer funds for the economy, the minor concession will likely ensure the bill’s passage.

Higher certainty of government spending is adverse for bonds and positive for the dollar – but what about weak data? Both ADP’s labor statistics for the private sector and the ISM Services Purchasing Managers’ Index fell short of expectations. The former showed an increase of only 117,000 private-sector jobs in February and the latter pointed to a slowdown in hiring in America’s largest sector. The figures only partially weighed on the greenback.

The ball now lies in the court of Federal Reserve Chair Jerome Powell, who will make his last public appearance before the bank enters its pre-rate decision “blackout period.” Will he change course and express concern over rising yields? So far, only Fed Governor Lael Brainard said that the move in bonds – that investors are obsessed about – “caught her eye.”

Other officials shrugged it off as a normal and even desirable outcome. The Fed sees higher returns on long-term bonds as a healthy development reflecting better growth prospects.

Powell may reiterate his previous calm message, echo Brainarad’s subtle warning, or pledge to push yields lower – thus triggering a downfall for the dollar.

See Powell Preview: Three scenarios for the Fed to defuse the bond bonfire, market implications

All in all, the pound is now in Powell’s hands.

GBP/USD Technical Analysis

Pound/dollar is battling the 100 Simple Moving Average no the four-hour chart while trading above the 200 SMA and below the 50 one, while momentum is virtually flat. All in all, a mixed picture.

Support awaits at 1.3935, which cushioned the pair on Wednesday. It is followed by 1.3915, the daily low. Further down, 1.3890 and 1.3860 await GBP/USD.

Resistance is at 1.3970, the daily high, followed by 1.40 – a psychologically significant barrier to the upside. The next lines to watch are 1.4025 and 1.4050.

Where next for the dollar as the Fed refocuses, bonds bring action, jobs set to cause jitters