- GBP/USD has been benefiting from falling US bond yields.

- Another bond auction and infrastructure spending may turn things around.

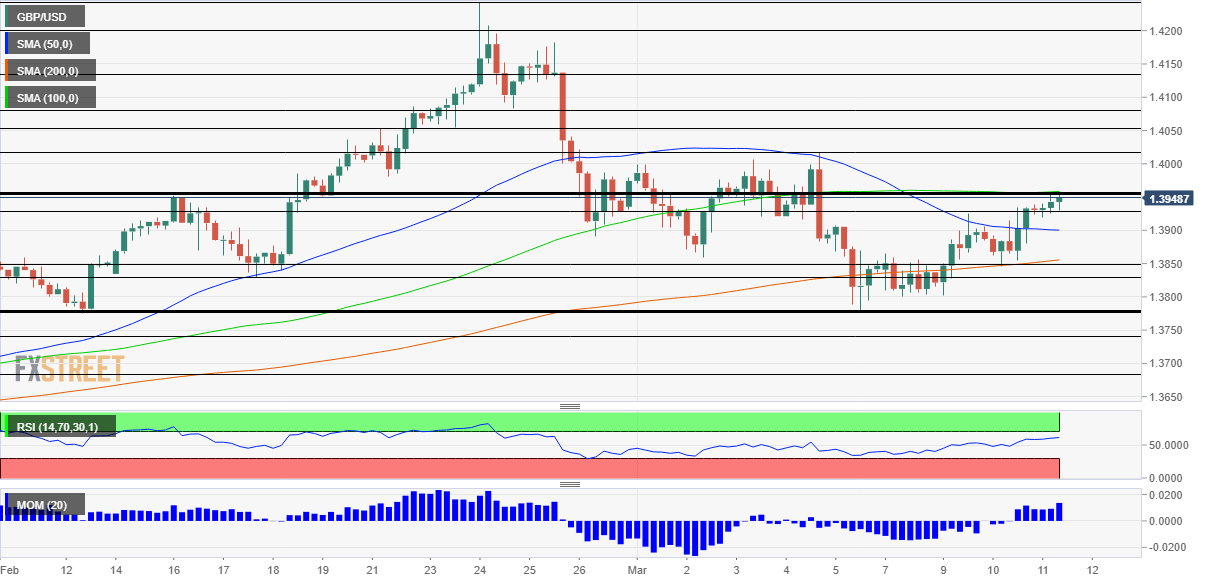

- Thursday’s four-hour chart is painting a bullish picture.

A disruption to Britain from America – no, not the royals’ “Night at Oprah’s” but the moves in GBP/USD triggered almost exclusively by US bond yields. An auction of ten-year Treasuries concluded with calm on Wednesday, allowing the dollar to retreat from its highs and cable to climb higher.

Will the upbeat mood in markets continue? After that successful offering, Uncle Sam is now selling 30-year bonds – which may already see weaker demand. An increase in returns on US debt linked to mortgages may send shivers down investors’ spines and boost the greenback.

See US 10-year Treasury Auction: Temporary relief

Another booster for the greenback may come from the White House. President Joe Biden has yet to sign the $1.9 trillion covid relief package approved by Congress, and new plans have already surfaced. The administration is reportedly examining a $2.5 trillion infrastructure bill, which may receive some Republican support for a change.

If additional headlines lay the ground for further spending, that would also push yields and the dollar higher. After Wednesday’s inflation figures missed estimates, Thursday’s weekly jobless claims will be of interest.

See US Initial Jobless Claims Preview: The two-track labor market returns

What about the pound? While the EU and the UK are at loggerheads over vaccine exports, but that does not seem to affect currencies. Britain’s vaccination campaign continues at full speed ahead, raising hopes for a quicker return to normality. Yet that is not news.

All in all, the next moves depend on the dollar, which may switch direction once again.

GBP/USD Technical Analysis

Pound/dollar is heading towards the 100 Simple Moving Average on the four-hour chart, which converges with the daily high of 1.3965. Momentum is to the upside and the pair already topped the 50 SMA. All in all, bulls are in the lead, but resistance remains significant.

Above 1.3965, the next hurdle is 1.4015, followed by 1.4050 and 1.4075.

Some support awaits at 1.3925, a swing high from earlier this week, followed by 1.3850, 1.3830 and 1.3775 – a strong support line.