- GBP/USD has been edging off the highs as US yields rise and ahead of PM Johnson’s speech.

- A cautious UK reopening may weigh on sterling but remarks from Fed Chair Powell may down the dollar.

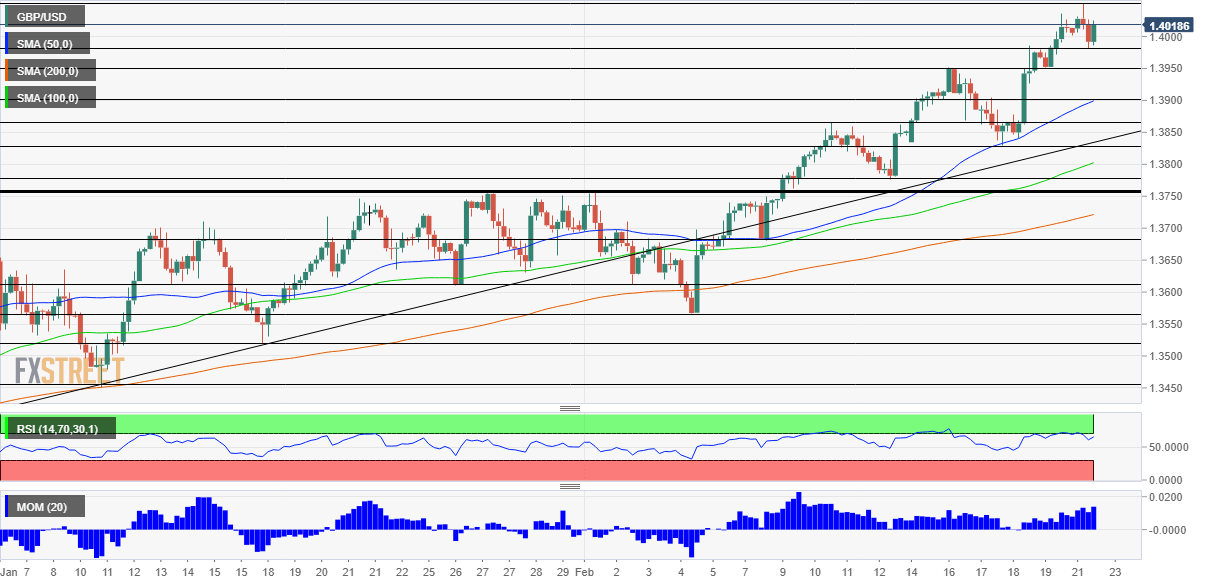

- Monday’s four-hour chart is showing bulls are in control.

Two friends can meet for coffee outside – and only in two weeks’ time – suggests one of the details leaked from Prime Minister Boris Johnson’s highly-anticipated reopening speech. Alongside other cautious moves, the PM’s moves are already triggering a “buy the rumor, sell the fact” response in sterling.

Britain’s rapid vaccination campaign and nationwide lockdown have yielded a sharp drop in COVID-19 infections, hospitalizations, and deaths, raising hopes for a quicker return to normality. According to the BBC’s Laura Kuenssberg, a five-week gap will separate the lockdown lifting steps – a snail’s pace in comparison to expectations.

The promise of a slow exit from the lockdown is that it will allow vaccinating more people and also diminish the chances of having yet another shuttering of the economy. Will that convince markets? At the moment, Boris’ lack of bravery seems to take the wind out of sterling’s sails.

GBP/USD is also weighed down by fresh dollar strength, stemming from higher US yields. Expectations of stronger growth – perhaps even overheating due to stimulus – is pushing investors away from US Treasuries. So far, the central bank has seen it is as a healthy sign of recovery. However, Federal Reserve Chairman Jerome Powell may provide a different point of view.

Powell is set to testify before Congress on Tuesday and his prepared remarks may be released already on Monday. If he reiterates the bank’s willingness to do more and opens the door to expanded bond-buying, yields could fall and the dollar could rise. While he is unlikely to commit to new and imminent stimulus, Powell’s commitment to do more may provide the next leg higher for GBP/USD.

All in all, these two forces – the slow UK reopening and Powell’s testimony – are closely watched, putting both countries’ vaccination campaigns on the sidelines.

GBP/USD Technical Analysis

Pound/dollar continues benefiting from upside momentum on the four-hour chart and also trades well above the 50, 100 and 200 Simple Moving Averages. Moreover, the recent dip pushed the Relative Strength Index away from the 70 level – thus further out from overbought conditions.

The fresh multi-year high of 1.4052 is the first resistance level to watch. It is followed by 1.4145, 1.4255 and 1.4370, all date back to 2018.

Support awaits at the daily low of 1.3980, then by 1.3950 and 1.39, which served as stepping stones on the way up.

More: GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits