- GBP/USD has advanced amid an improving market mood.

- All eyes are on US Nonfarm Payrolls, published amid thin liquidity.

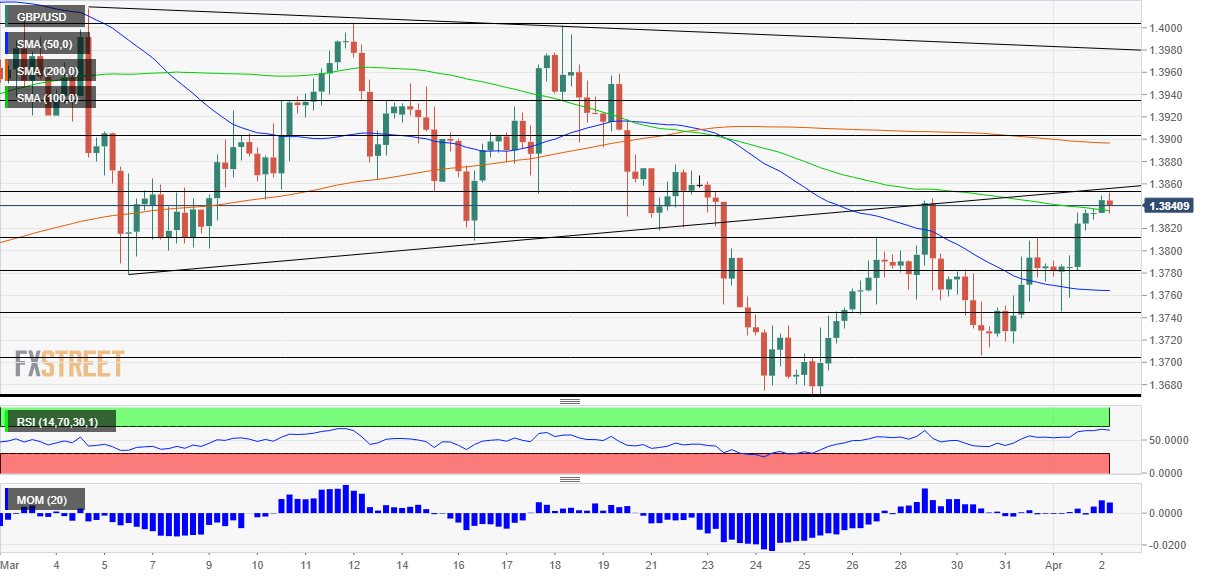

- Friday’s four-hour chart is painting a bullish picture.

A 180-degrees turn back down or 180 pips up to the previous peak? One thing is all but certain – volatility is set to surge once the US Nonfarm Payrolls are released. Good Friday is a holiday in most parts of the world, but America’s Bureau of Labor Statistics still publishes the all-important job figures on this day.

The US is on an accelerating recovery path amid a solid vaccination campaign, state reopenings, two rounds of stimulus checks – and optimism about a new infrastructure package. While the latter development may take time to come into fruition, US industry is already firing on all cylinders. The ISM Manufacturing Purchasing Managers’ Index smashed expectations with a score of 64.7 in March, the highest since 1983.

Economists expect an increase of 647,000 jobs, a considerable jump from 379,000 created in February. The jobless rate is forecast to drop from 6.2% to 6%, but markets will likely focus on the headline figure. If the NFP exceeds projections – and some think it may hit one million – the dollar could rise as investors begin pricing in an interest rate hike.

- US Nonfarm Payrolls March Preview: Optimism and evidence this time?

- Nonfarm Payrolls Preview: Five reasons why hiring is set to skyrocket, dollar may follow

Leading to the publication, the greenback has been on the back foot, dropping alongside bond yields. Investors seem to shrug off President Joe Biden’s new plans, which include tax hikes and are running against opposition in Congress. Moreover, rising COVID-19 cases in the US – despite rapid immunization – also curb some of the enthusiasm.

While the NFP may boost the dollar, sterling is well-positioned to weather the storm. Contrary to America, infections are dropping in Britain. That may allow GBP/USD to rise if the figures fall short of expectations. Technicals also show an improving picture for the pound.

GBP/USD Technical Analysis

Pound/dollar has set a higher high after bottoming out at a better level earlier in the week, as the four-hour chart is showing. This emerging uptrend is also reflected in rising momentum and the currency pair’s surpassing of the 100 Simple Moving Average. All in all, bulls gaining ground.

Some resistance is at the daily high of 1.3850, followed by 1.39, which provided support during MArch. Further above, 1.3935 and 1.40 are eyed.

Support is at 1.3810, a swing high from earlier this week. It is followed by 1.3780, 1.3740 and 1.37.

More Armageddon has been postponed: Cryptocurrencies and market realities