- GBP/USD has been struggling to recover despite falling US bond yields.

- A hit in supplies of vaccines is set to slow down Britain’s campaign.

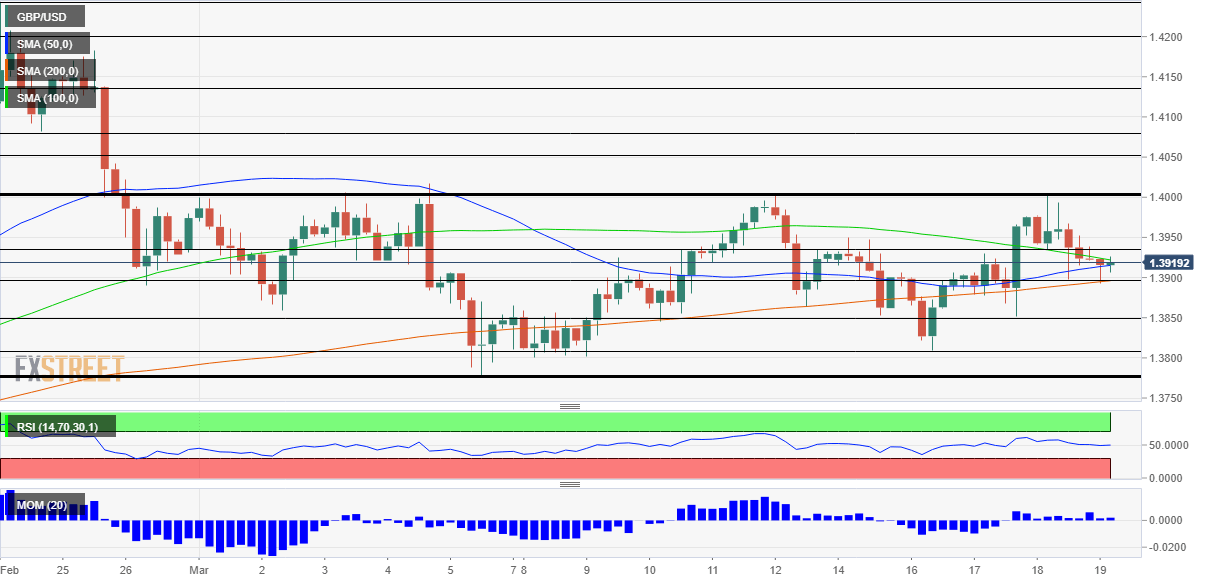

- Friday’s four-hour chart is painting a balanced picture.

“A technical issue” – UK Prime Minister Boris Johnson explained a delay in immunization doses manufactured in India. Whether it is indeed a production or shipping problem or rather a vaccine nationalism is unlikely to matter to markets.

One of sterling’s critical drivers has been the UK’s rapid campaign to protect its population. While some 38% of Brits have received one jab, only a few have been administered the second dose, and a delay may derail the exit from the current lockdown. In addition, the clashes with the EU are unhelpful either.

GBP/USD has been holding up early on Friday thanks to some calm in US bond yields. Returns on Uncle Sam’s ten-year debt has dropped below the round 1.70% level but may resume its gains later on. Moves in the dollar have been directly correlated with this global benchmark.

Investors continue digesting decisions by central banks earlier this week. Both the Bank of England and the Federal Reserve acknowledged improvements in their respective economies and better prospects for the rest of 2021. However, both institutions want to see inflation rising before acting. Nevertheless, the an increase in returns on US debt has more impact than any upward move in UK Gilt yields.

A somewhat forgotten factor moving the dollar has also returned to the scene – Sino-American relations. High-level talks between the world’s largest economies resulted in mutual accusations and seemingly little progress to resolve outstanding issues on trade, Taiwan, Hong-Kong, Xinjiang, and other topics. The greenback has received some flows.

All in all, GBP/USD’s balance may have been broken, with bears gaining ground.

GBP/USD Technical Analysis

Contrary to the fundamental picture, the technical one is more balanced. Momentum on the four-hour chart is marginal to the upside and the 50, 100 and 200 Simple Moving Averages are converging around 1.3910.

Some support awaits at 1.39, which is the daily trough, followed by 1.3850, a swing low from earlier this week. It is followed by 1.3810 and by 1.3775, March’s bottom.

Some resistance is at 1.3930, which capped cable last week, and then by 1.40, the psychological barrier and a double-top. Further above, 1.4050 and 1.4075 are eyed.