GBP/JPYÂ Daily Chart

Technical Outlook: GBP/JPY broke above long-term trendline resistance extending off the 2015 highs this month with the advance now approaching the first major resistance hurdle just ahead of the 152-handle. This threshold is defined by the 38.2% retracement of the 2015 decline and converges on the upper parallel over the next few days.

GBP/JPYÂ 240min

Notes: A closer look at price action sees GBP/JPY trading within the confines of an ascending pitchfork formation extending off the June lows with the 50-line further highlighting this near-term resistance zone. Look for interim support at the 150-handle with our focus higher in the pair while above 148.43. A breach above the 152-figure keeps the long-bias in play targeting subsequent resistance objectives at the upper median-line parallel / 154.70.

A break below the May high-day close at 147.86 would be needed to suggest a deeper correction is underway with such a scenario targeting 146.71 & 145.45. Bottom line: the broader focus remains higher but look for a pullback to offer entries while above the median-line. Keep in mind that the breach made early this month is technically significant and suggests there’s lots of upside potential here- we’re simply at risk for a pullback and trying to gauge the depth of that pullback is always tricky- stay nimble.

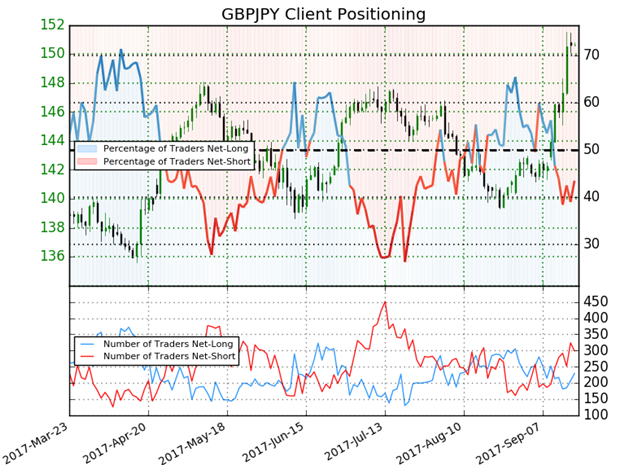

- A summary of IG Client Sentiment shows traders are net-long GBPJPY- the ratio stands at -1.3 (43.5% of traders are long) – weak bullish reading

- Long positions are 5.0% higher than yesterday and 16.1% lower from last week

- Short positions are 6.9% lower than yesterday and 53.3% higher from last week

- We typically take a contrarian view to crowd sentiment and the fact traders are net-short suggests GBPJPY prices may continue to rise. However, retail is less net-short than yesterday but more net-short from last week and the combination of current positioning and recent changes gives us a further mixed GBPJPY bias from a sentiment standpoint.