The latest report by Commodity Futures Trading Commission (CFTC) covering data up to February 25th shows that bullish sentiment continues to build towards European major currencies like the Euro and the GBP, in addition the Swiss Franc net position returned to the long side. At the same time the negative bias increases slightly with the Japanese Yen. The net short position with the Australian Dollar and the Canadian Dollar moderated somewhere to $3.51 billion and $5.28 billion respectively.

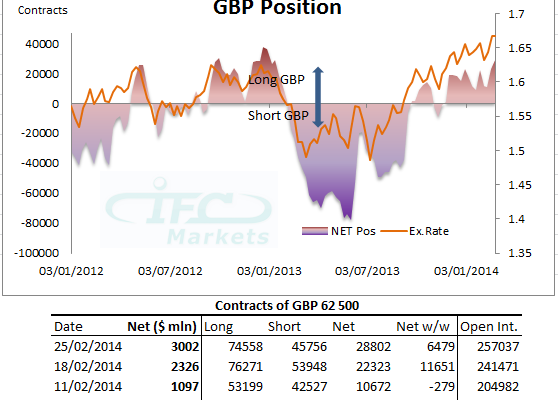

The Euro had the biggest weekly change for one more week. The net long position increased to $2.38 billion ahead of the European Central Bank meeting that could further increase bullish sentiment or suppress it. The British Pound maintains bullish bias as well as the largest net long position amounting of $3.00 billion. The British Pound speculative net long position measured in US Dollars has reached a fresh peak and that creates some contrarian expectations.

Traders have covered somewhat their short positions on the Australian Dollar and the Canadian Dollar with a longer term trend still negative on both currencies. The Japanese Yen bearish bias enhancement has been the largest during the last week, however that does not reflect recent risk averse due to Ukraine tensions.