Following an uneventful week which saw the Bank of Canada and the European Central Bank maintaining the status quo, the pace of economic data is seen to be slowing in the coming week. While last week was all about inflation numbers, this week the focus shifts to GDP numbers coming out of the US, UK, and France.

US third quarter GDP growth

The US dollar will be looking to a relatively slow start to the week with most of the first half of the week seeing flash PMI data for the month of October. Following the turnaround in the PMI’s (both Markit and ISM), the preliminary data will give a view of the manufacturing and non-manufacturing sector performance. US durable goods numbers will be coming up on Thursday. After a 0.2% decline in core durable goods orders and a flat print on the headline for August, the numbers for October are forecast to rise 0.2% and 0.1% respectively.

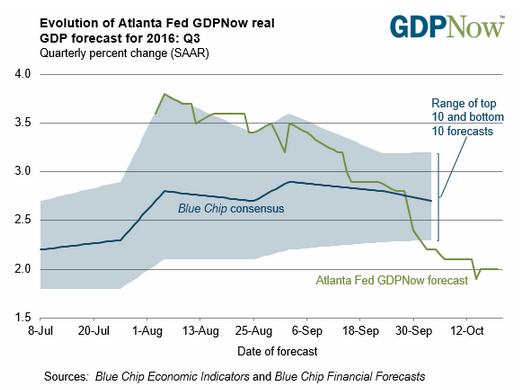

AtlantaFed GDPNow: Forecasts 2.0% Q3 GDP

The week is also marked by several Fed member speeches ahead of the October 25 blackout period in the runup to early November FOMC meeting. The markets are currently assigning a 20% probability of a rate hike at the November meeting.

Friday’s advance GDP report will be the main event risk for the US dollar and its peers. After a slow period of growth in Q1 and Q2, expectations are high with forecasts pointing to a 2.50% increase in growth. In the second quarter, US GDP registered a meager 1.40% GDP growth.

Australia quarterly inflation

Ahead of the RBA’s meeting in November, the third quarter inflation figures will be released this Wednesday. After a 0.40% increase in headline inflation during the second quarter, economists are expecting to see the third quarter inflation rise 0.5%. The trimmed mean CPI is expected to rise 0.4% during the quarter, following a 0.50% increase previously.

Last week, the new RBA Governor, Philip Lowe gave his first speech where he ruled out further rate cuts while expressing concerns that inflation could be well anchored to the downside. As long as the third quarter inflation does not surprise to the downside, the RBA is expected to keep interest rates on hold in the coming weeks.