EUR/USD

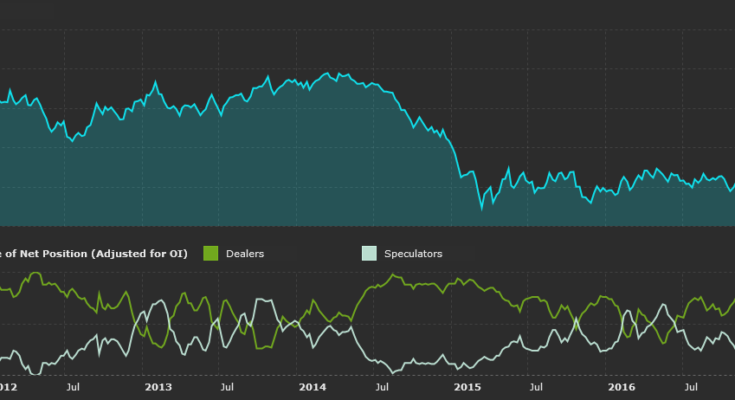

Non-Commercials increased their net long positions in the Euro last week buying a further 9.8k contracts to take the total position to 96k contracts. This latest increase in buying strength came ahead of the ECB’s September meeting which was widely expected to see the bank announcing further QE tapering. Despite the high level of expectation, the ECB maintained policy and instead gave a signal that it is likely to announce tapering at the upcoming October meeting.

The statement was mostly unchanged from the prior meeting, but there were revisions to the bank’s growth, and inflation forecasts with growth revised higher inflation downgraded. Economic data has been surprising to the upside recently though underlying inflation remains a drag and the strength of EUR has been noted as a negative factor in that context.

GBP/USD

Non-Commercials increased their net short positions in Sterling last week selling a further 1.4k contracts to take the total position to -53k contracts. GBP has been under steady selling pressure over the last month as Brexit-linked uncertainty continues to grow. The build in short positions reflects negative investor sentiment in the UK currency which has also seen selling in response to weaker data recently.

This week, traders will be focused on domestic inflation data which is forecast to have ticked up over August. CPI has recently lost topside momentum so a strong reading this week will be received positively by the BOE who meet on Thursday for their September meeting. Â The BOE is not expected to adjust policy at this meeting, but trader should be aware of the risk of a more hawkish tone with the bank highlighting the growing need for a rate rise, sooner rather than later.

USD/JPY

Non-Commercials increased their net short positions in the Japanese Yen last week selling a further 4.4k contracts to take the total position to -73k contracts. The increase in short positioning last week seems misaligned. JPY has seen steady short-covering over recent weeks as safe-haven demand has resurfaced in light of the nuclear threat from North Korea. Consequently, short position has been reduced by almost half since the middle of the summer as investors choose to store their capital in the safe haven yen.