If yesterday’s selloff catalysts were largely obvious, if long overdue, in the form of the record collapse of Espirito Santo coupled with the Argentina default, German companies warning vocally about Russian exposure, the ongoing geopolitical escalations, and topped off by a labor costs rising and concerns this can accelerate a hiking cycle, overnight’s latest dump, which started in Europe and has carried over into US futures is less easily explained although yet another weak European PMI print across the board, with UK manufacturing growing at the slowest pace in a year in July as a cooling in new orders and output ended the first half’s “stellar growth spurt”, probably didn’t help.

This is how Goldman explained the latest manufacturing surveys out of Europe:

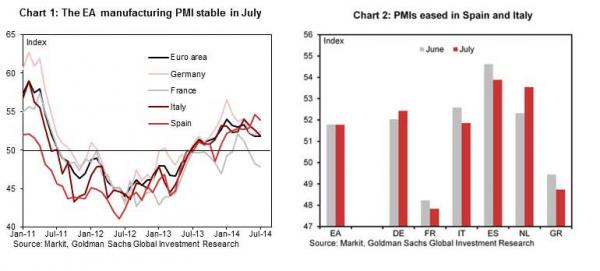

The Euro area final manufacturing PMI printed at 51.8 in July, 0.1pt below the Flash and the consensus estimate (Flash, Cons: 51.9). This implies a flat reading relative to the June print. The French component was revised up relative to the flash (+0.2pt), while the German component was revised down (-0.4pt). The July figure showed a loss of momentum in both Italy and Spain, with the manufacturing PMI easing 0.7pt in both countries (against a consensus expectation of around flat outcomes in July).

The Euro area aggregate Final manufacturing PMI printed at 51.8, 0.1pt below the July Flash owing to a considerable 0.4pt downward revision in Germany, outweighing a 0.2pt upward revision in France.

Relative to the June print, the Final July manufacturing PMI shows a 0.4pt increase in Germany (to 52.4) and a 0.4pt decline in France (to 47.8). The Italian manufacturing PMI fell by 0.7pt (to 51.9) against expectations of a stable reading (Cons: 52.5). The Italian PMI has eased 2pt since its recent peak in April, but otherwise remains close to or above the levels observed since the spring of 2011. Its Spanish counterpart also declined by 0.7pt (Cons: 54.5), but remains robust at a relatively high level of 53.9, close to its highest level since mid-2007. Developments outside the EMU4 were mixed: the Dutch PMI rose 1.2pt (to 53.5) while the Greek PMI declined 0.7pt (as in Spain/Italy) to 48.7. The Irish PMI ticked up 0.1pt and remains very solid at 55.4.

However, one can hardly blame largely unreliable “soft data” for what is rapidly becoming the biggest selloff in months and in reality what the market may be worried about is today’s payroll number, due out in 90 minutes, which could lead to big Treasury jitters if it comes above the 230K expected: in fact, today is one of those days when horrible news would surely be great news for the momentum algos.

More importantly even than the noisy jobs number, the Fed will increasingly be looking at the quality composition of jobs (full time vs part time), and whether wages are growing: watch hourly earnings today as the FOMC have shifted towards wages as one of their main criteria for when to become more hawkish. The market is expecting this to stay at 0.2% M/M but the year-on-year number is tipped to increase to +2.2% Y/Y (vs 2.0% previous).

Still, with futures down 0.6% at last check, it is worth noting that Treasurys are barely changed, as the great unrotation from stocks into bonds picks up and hence the great irony of any rate initiated sell off: should rates spike on growth/inflation concern, the concurrent equity selloff will once again push rates lower, and so on ad inf. Ain’t central planning grand?

Heading into the North American open, stocks in Europe are seen lower across the board, with peripheral indices underperforming where Banco Espirito Santo (-6.47%) remained in focus and revived investor angst over the stability of the banking system. The broad based sell off saw DAX index fall to within a touching distance of the low printed in mid-April at 9166.53. Of note, front page of the WSJ reads ‘hedge funds wager on a fall’ saying that many Wall Street money managers who anticipated the US housing bubble see more trouble on the horizon. (WSJ)

Turning to overnight markets, Asian equities are trading lower as a carryover of what we saw yesterday. However, all major bourses are off their respective opening lows and S&P500 futures are up 0.22%. The Asia and Australian iTraxx indices are off the wides of around +4-5bp. Given the sharpness of the EM selloff yesterday, Indonesian USD sovereign bonds have sold off 10bp but there has been some reported buying at the lows. The official Chinese manufacturing PMI was better than consensus estimates (51.7 vs 51.4) and this is also helping risk sentiment recover a bit through the session.